Common mistakes

-

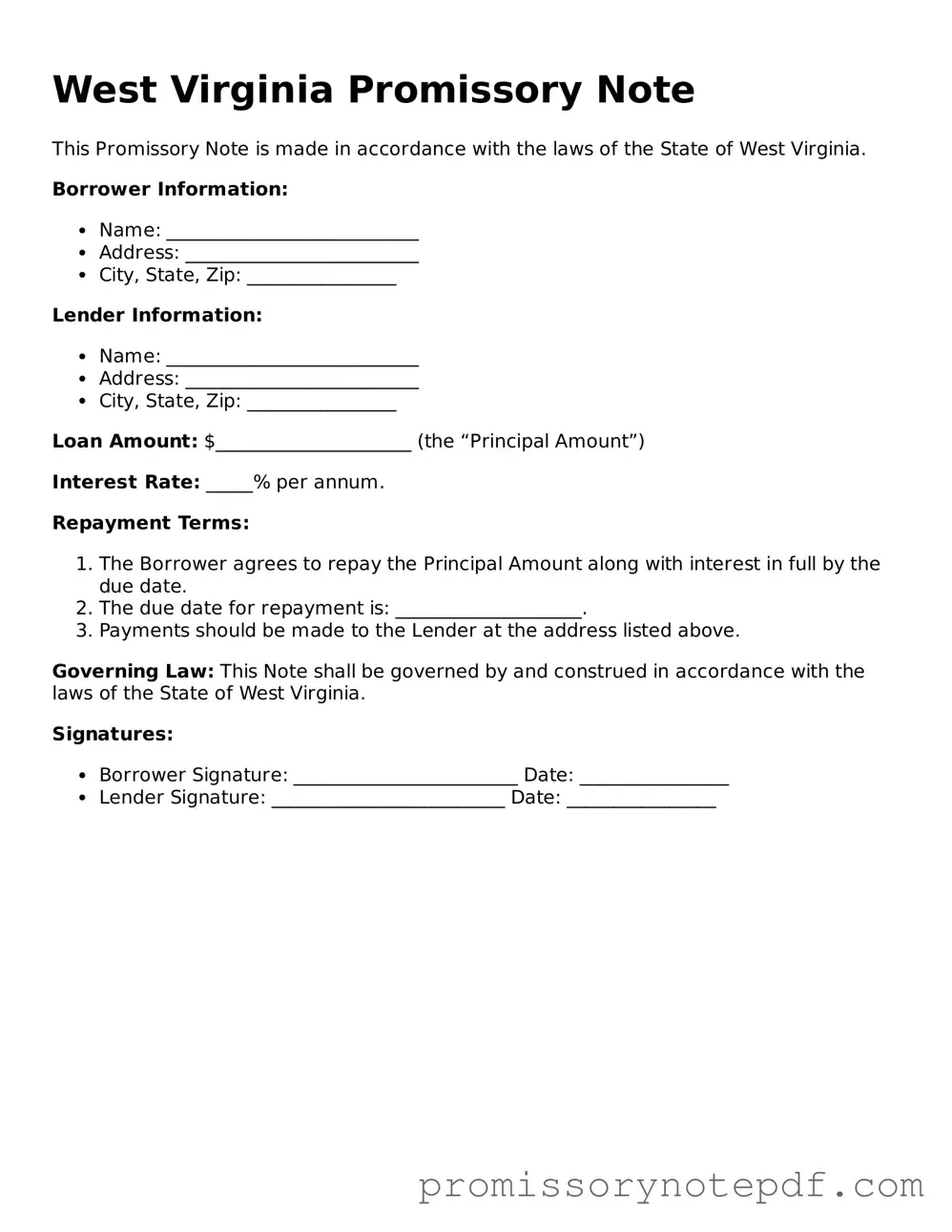

Failing to include all necessary parties: It's crucial to list both the borrower and the lender. Omitting one can lead to confusion or disputes later on.

-

Not specifying the loan amount: Clearly stating the amount borrowed is essential. Leaving this blank can create misunderstandings about the terms of the loan.

-

Ignoring interest rates: If the loan carries interest, it should be explicitly mentioned. Failing to do so might result in unexpected costs for the borrower.

-

Neglecting repayment terms: Clearly outline how and when the borrower will repay the loan. Vague terms can lead to disputes down the line.

-

Omitting a due date: A specific due date for repayment should be included. Without it, both parties may have different expectations.

-

Not including a default clause: This clause outlines what happens if the borrower fails to repay. Without it, the lender may have limited options if issues arise.

-

Forgetting to sign and date: A Promissory Note is not valid without signatures from both parties. Ensure that the document is signed and dated to make it legally binding.

-

Using unclear language: Avoid vague terms. Clear and precise language helps prevent misunderstandings between the lender and borrower.

-

Not keeping copies: Both parties should retain copies of the signed Promissory Note. This serves as a reference in case of any disputes or questions.

-

Failing to consult a legal professional: It’s wise to seek advice from a legal expert when drafting or signing a Promissory Note. They can help ensure that all terms are fair and legally enforceable.