Common mistakes

-

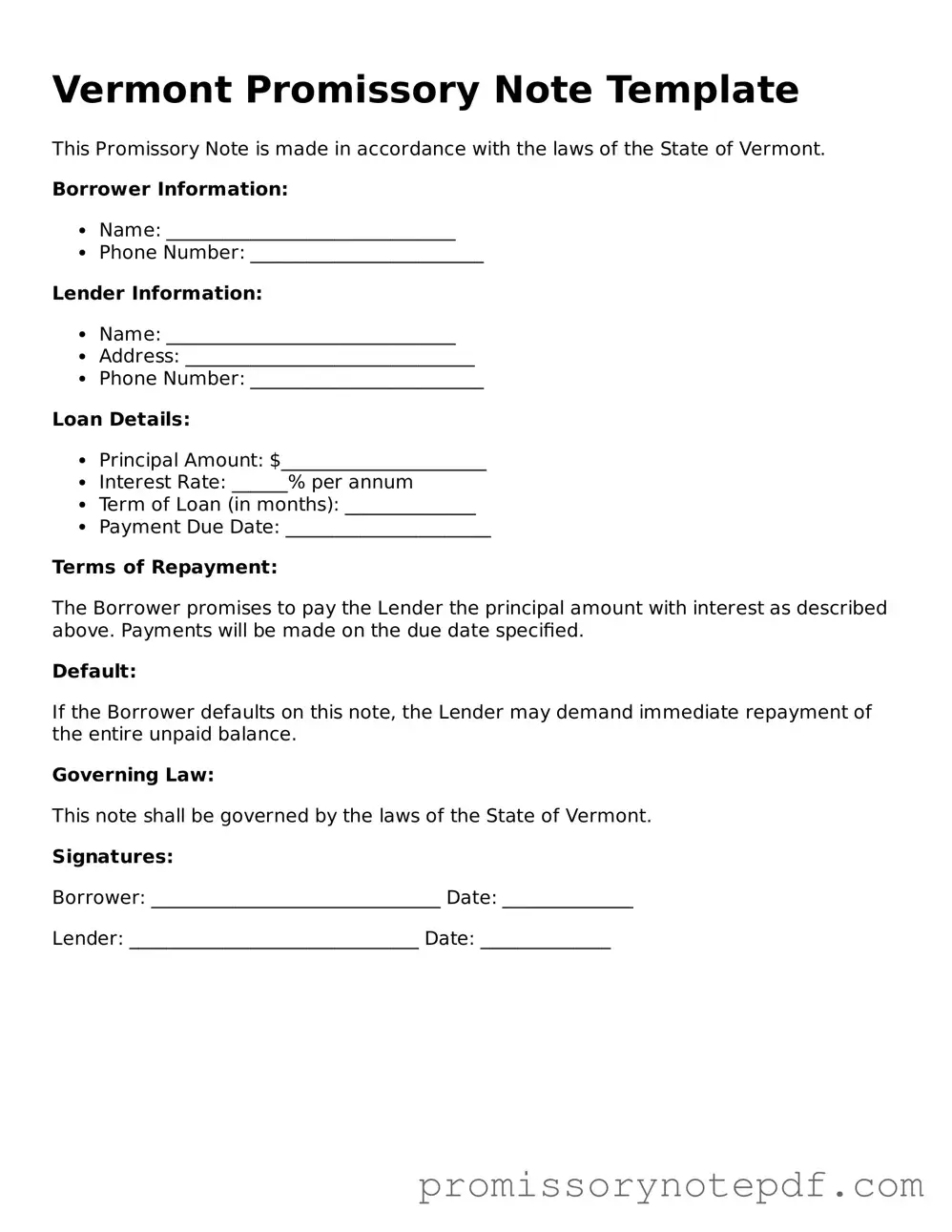

Incorrect Borrower Information: Failing to provide accurate names or addresses can lead to confusion. Ensure that the borrower’s full legal name and current address are clearly stated.

-

Missing Lender Details: Just as with the borrower, it is essential to include the lender's complete name and address. Omitting this information may complicate future communications.

-

Inadequate Loan Amount Specification: Clearly stating the exact amount of the loan is crucial. Rounding off or providing an estimate can create disputes later.

-

Failure to Specify Interest Rate: Not indicating whether the loan is interest-bearing or not can lead to misunderstandings. If interest is applicable, specify the rate clearly.

-

Vague Repayment Terms: Outlining the repayment schedule is vital. Be specific about due dates and payment amounts to avoid confusion.

-

Not Including Default Terms: It is important to outline what constitutes a default. Failing to do so can leave both parties uncertain about their rights and obligations.

-

Ignoring Signatures: The document must be signed by both the borrower and the lender. Neglecting to sign can render the note unenforceable.

-

Not Dated: A promissory note should always include the date it was signed. Omitting the date can create ambiguity regarding the start of the repayment period.

-

Failure to Keep Copies: After signing, both parties should retain a copy of the note. Without this, proving the terms of the agreement can become challenging.