Common mistakes

-

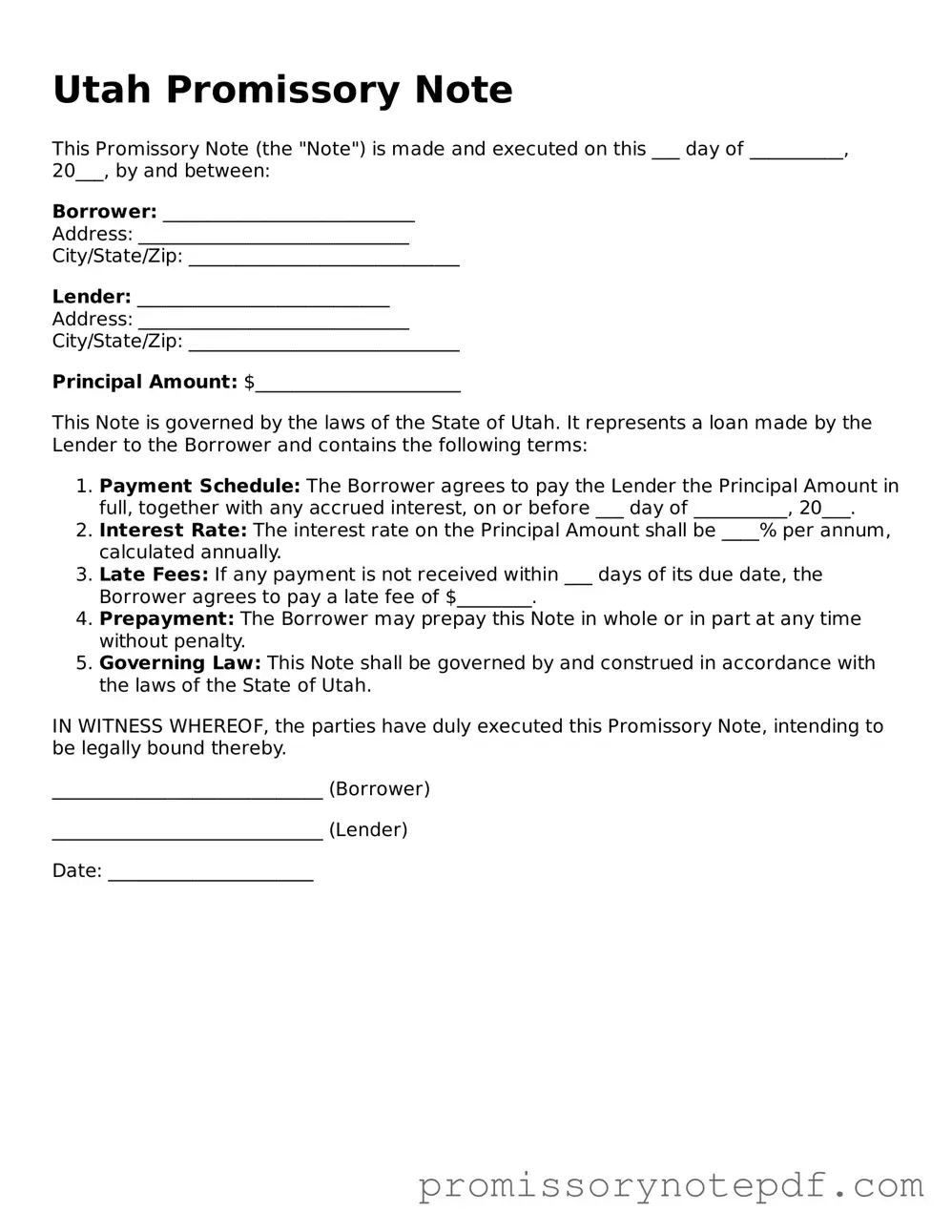

Incorrect Borrower Information: Failing to provide accurate details about the borrower can lead to confusion later. It’s essential to include the full name and current address.

-

Missing Lender Details: Just as with the borrower, omitting the lender’s information can complicate matters. Ensure that the lender’s name and contact information are clearly stated.

-

Inadequate Loan Amount: Entering an incorrect loan amount can create disputes. Double-check the figures to ensure they match the agreed-upon terms.

-

Failure to Specify Interest Rate: Not including the interest rate or leaving it blank can lead to misunderstandings. Clearly state the rate to avoid future complications.

-

Omitting Payment Terms: It’s vital to outline how and when payments will be made. Without this information, both parties may have different expectations.

-

Neglecting Signatures: A common mistake is forgetting to sign the document. Both the borrower and lender must sign for the note to be valid.

-

Not Including a Date: Leaving the date section blank can cause issues down the line. Always date the document to establish when the agreement was made.

-

Overlooking Witness or Notary Requirements: Depending on the situation, a witness or notary may be necessary. Failing to include this can affect the enforceability of the note.