Common mistakes

-

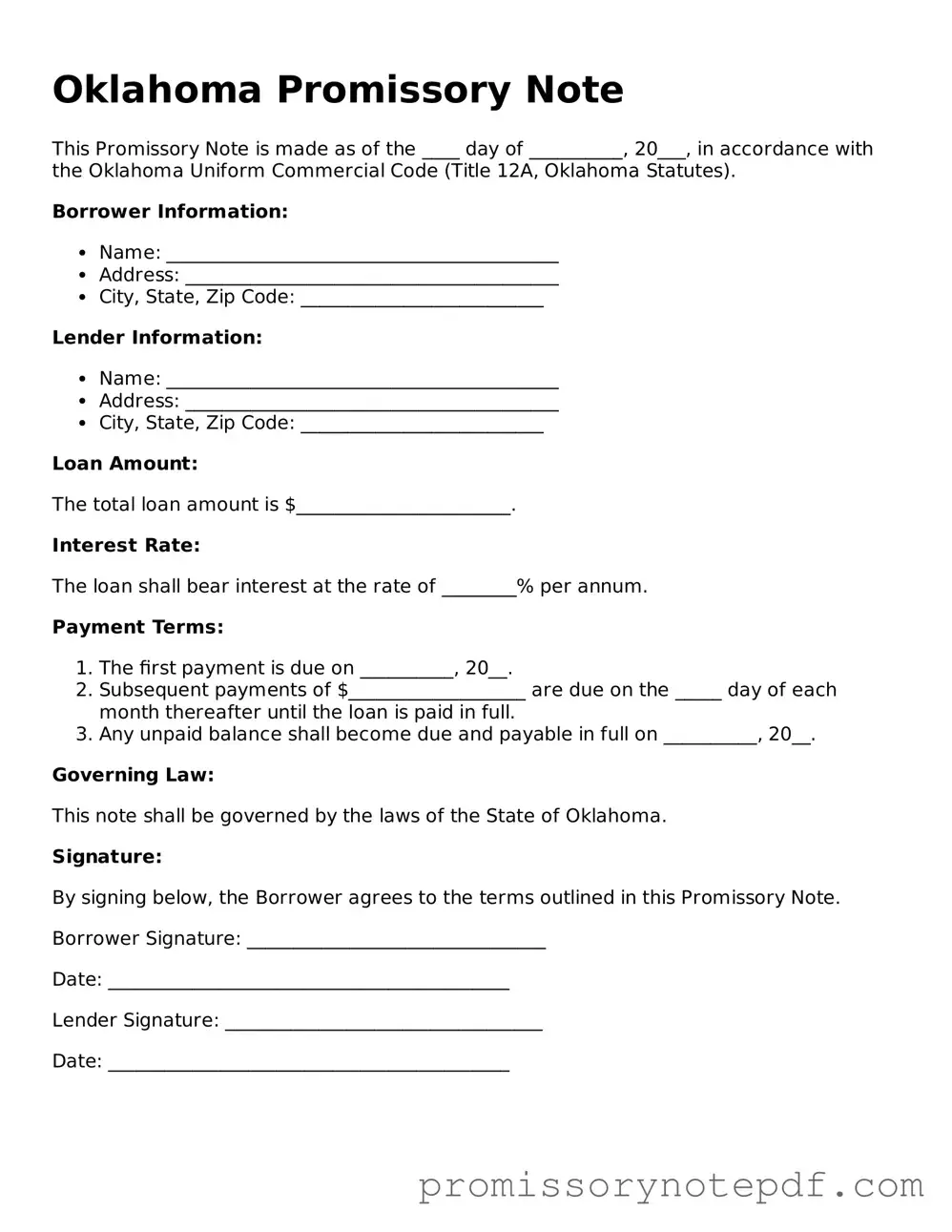

Incorrect Borrower Information: Failing to provide the full legal name of the borrower can lead to confusion and potential legal issues.

-

Missing Lender Details: Not including the lender’s name and contact information can complicate communication and enforcement of the note.

-

Ambiguous Loan Amount: Writing the loan amount in words but not in numbers, or vice versa, can create discrepancies.

-

Omitting Interest Rate: Forgetting to specify the interest rate may lead to misunderstandings about the cost of borrowing.

-

Unclear Payment Terms: Not clearly outlining the payment schedule can result in confusion regarding when payments are due.

-

Neglecting Signatures: Failing to sign the document, or missing the signature of a witness, can render the note invalid.

-

Not Initialing Changes: If any corrections are made, neglecting to initial those changes can lead to disputes later.

-

Ignoring State-Specific Requirements: Overlooking specific Oklahoma laws or regulations related to promissory notes can lead to legal complications.

-

Inadequate Date Information: Not including the date of the agreement can create uncertainty about the timeline of the loan.

-

Failure to Keep Copies: Not retaining a copy of the signed note for both parties can lead to issues in the future if disputes arise.