Common mistakes

-

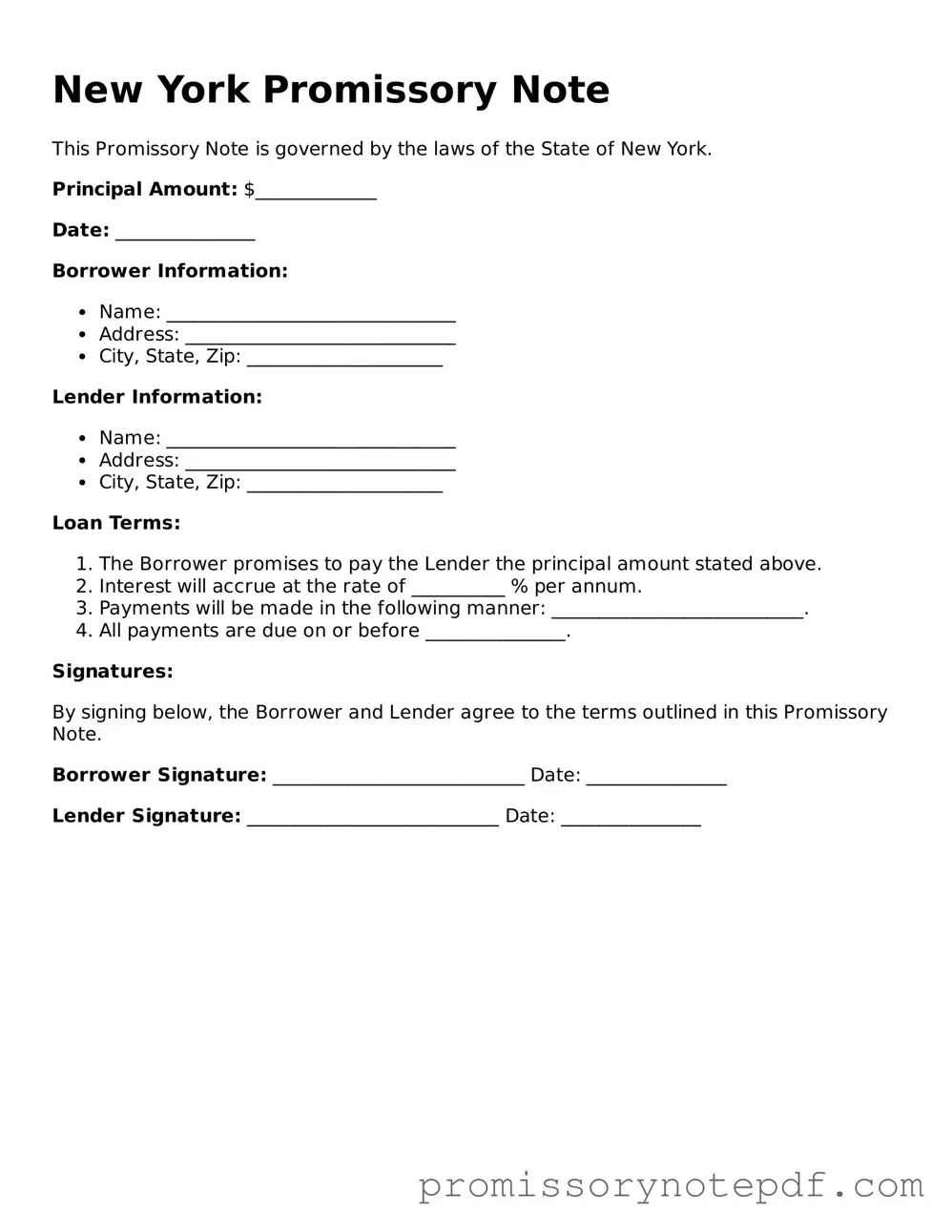

Inaccurate Borrower Information: One common mistake is providing incorrect or incomplete information about the borrower. This includes missing names, addresses, or contact details. Ensure that all personal information is accurate to avoid complications later.

-

Omitting Loan Amount: Failing to clearly state the loan amount can lead to confusion. It's essential to specify the exact dollar figure being borrowed, as ambiguity can result in disputes over repayment expectations.

-

Ignoring Interest Rate Details: Some individuals neglect to include the interest rate or mistakenly write it down. This omission can create misunderstandings regarding how much the borrower will ultimately owe. Clearly define the interest rate to avoid future conflicts.

-

Not Specifying Payment Terms: Another frequent error is not detailing the payment schedule. Whether the borrower will make monthly payments or a lump sum at the end, clarity is key. Outline the payment terms to ensure both parties have the same understanding.

-

Failure to Sign and Date: Lastly, forgetting to sign or date the document is a critical mistake. Without signatures, the note may not be legally binding. Both parties should sign and date the form to confirm their agreement.