Common mistakes

-

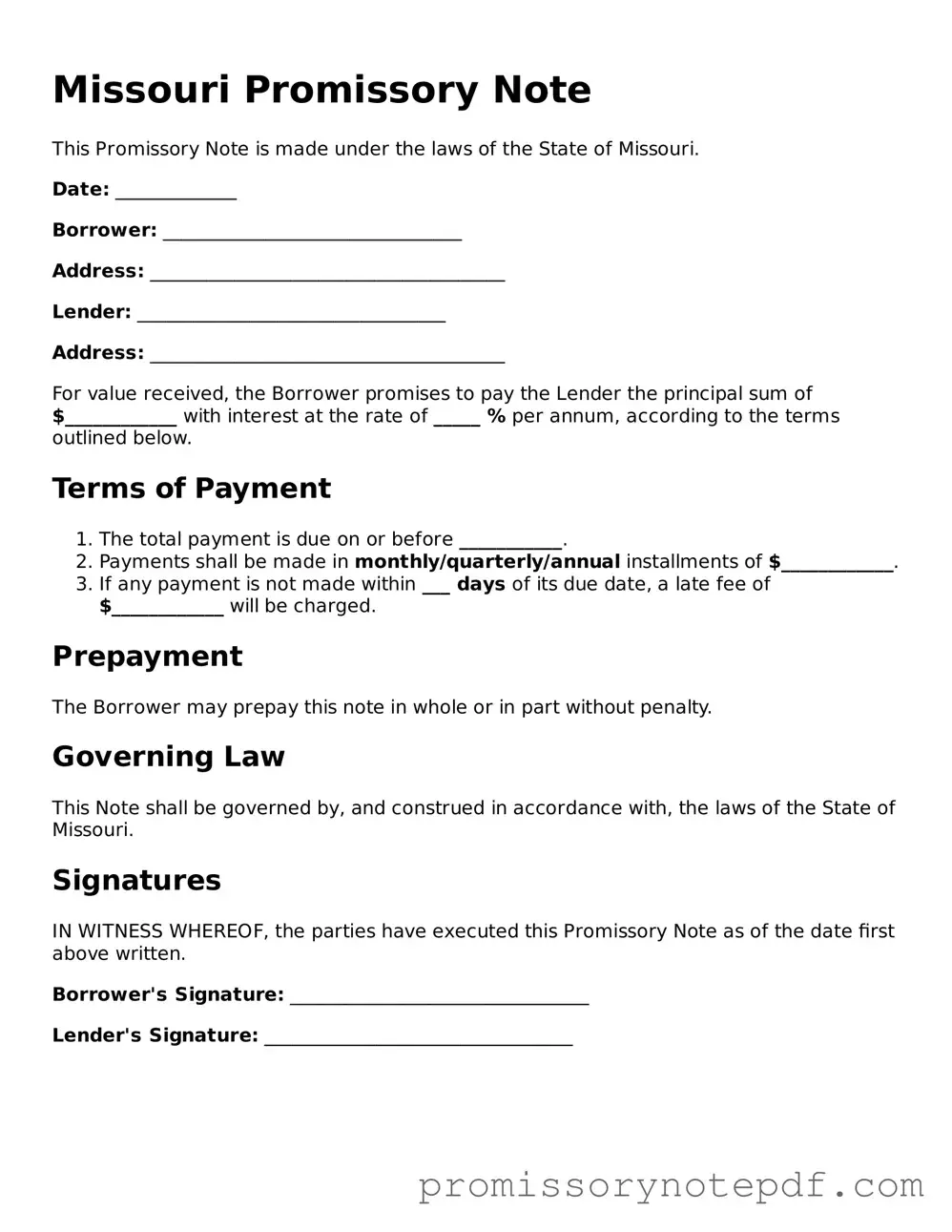

Incorrect Date: Failing to enter the correct date when the note is signed can lead to confusion regarding the terms of repayment.

-

Missing Borrower Information: Not providing complete details about the borrower, such as their full name and address, can complicate enforcement of the note.

-

Omitting Lender Information: Similar to borrower information, neglecting to include the lender's full name and address may create issues in the future.

-

Unclear Loan Amount: Writing the loan amount inaccurately or ambiguously can lead to disputes over the actual amount owed.

-

Failure to Specify Interest Rate: Not indicating whether interest will be charged or leaving the rate blank can lead to misunderstandings.

-

Ignoring Repayment Terms: Failing to clearly outline the repayment schedule, including due dates and payment amounts, can result in confusion and missed payments.

-

Not Including Default Terms: Omitting what happens in the event of default can leave both parties unprotected and uncertain about their rights.

-

Neglecting Signatures: Forgetting to sign the note or have it signed by the borrower and lender can render the document unenforceable.

-

Not Keeping Copies: Failing to make copies of the signed note for both parties can lead to disputes over the terms and existence of the agreement.