Common mistakes

-

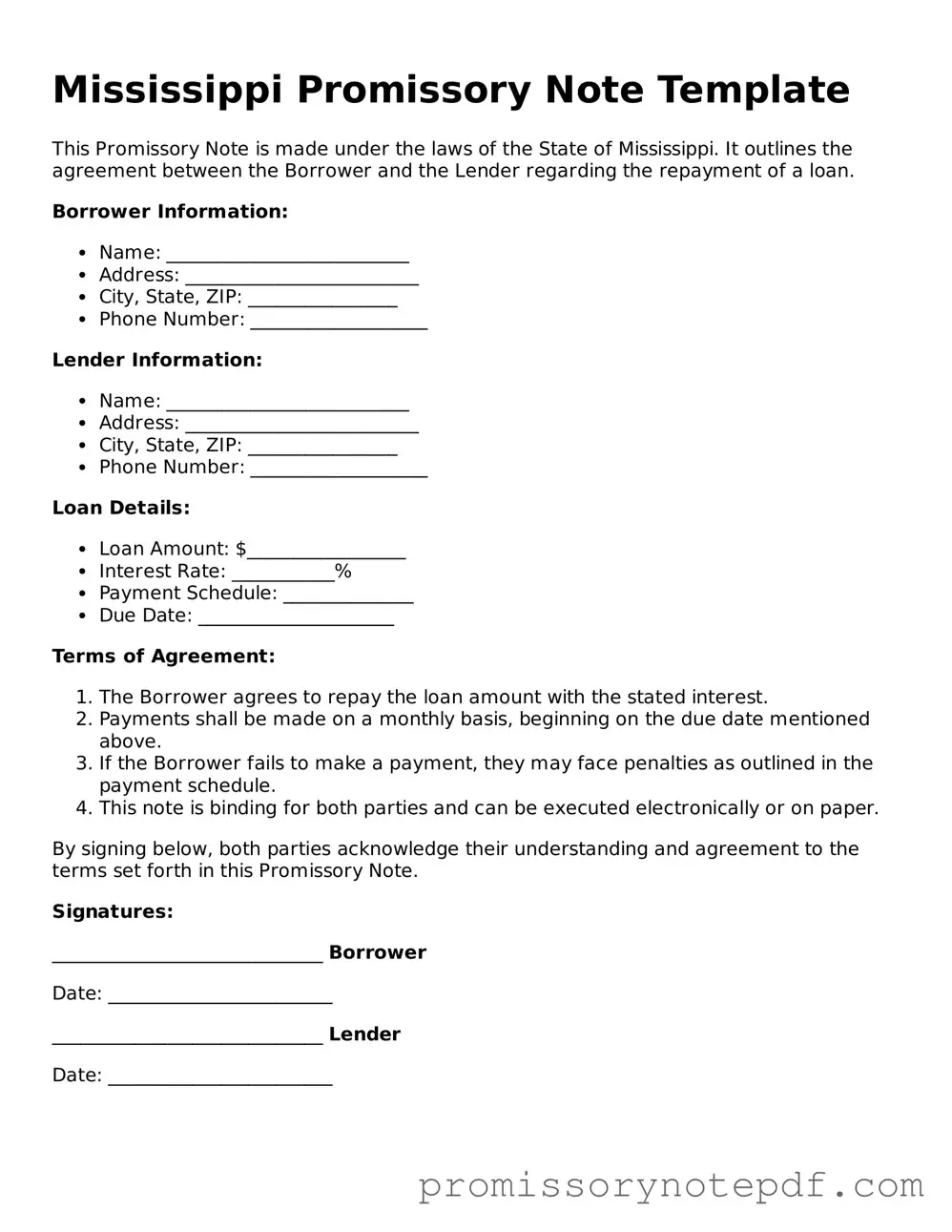

Incorrect Names: One of the most common mistakes is misspelling names or using incorrect legal names. Always double-check the spelling of both the borrower and lender’s names to ensure accuracy.

-

Missing Dates: Failing to include the date of the agreement can lead to confusion. Make sure to clearly indicate when the note is signed.

-

Improper Amount: Entering the wrong loan amount is a significant error. Verify the amount before finalizing the document to avoid disputes later.

-

Vague Terms: Some people use unclear or vague terms regarding repayment. Be specific about payment schedules, interest rates, and any penalties for late payments.

-

Lack of Signatures: Not signing the document or forgetting to have a witness can invalidate the note. Ensure that all necessary parties sign the document.

-

Ignoring State Laws: Each state has its own regulations regarding promissory notes. Familiarize yourself with Mississippi’s specific requirements to avoid legal issues.

-

Not Keeping Copies: After filling out the form, some forget to keep copies for their records. Always retain a signed copy for both parties to refer back to in the future.