Common mistakes

-

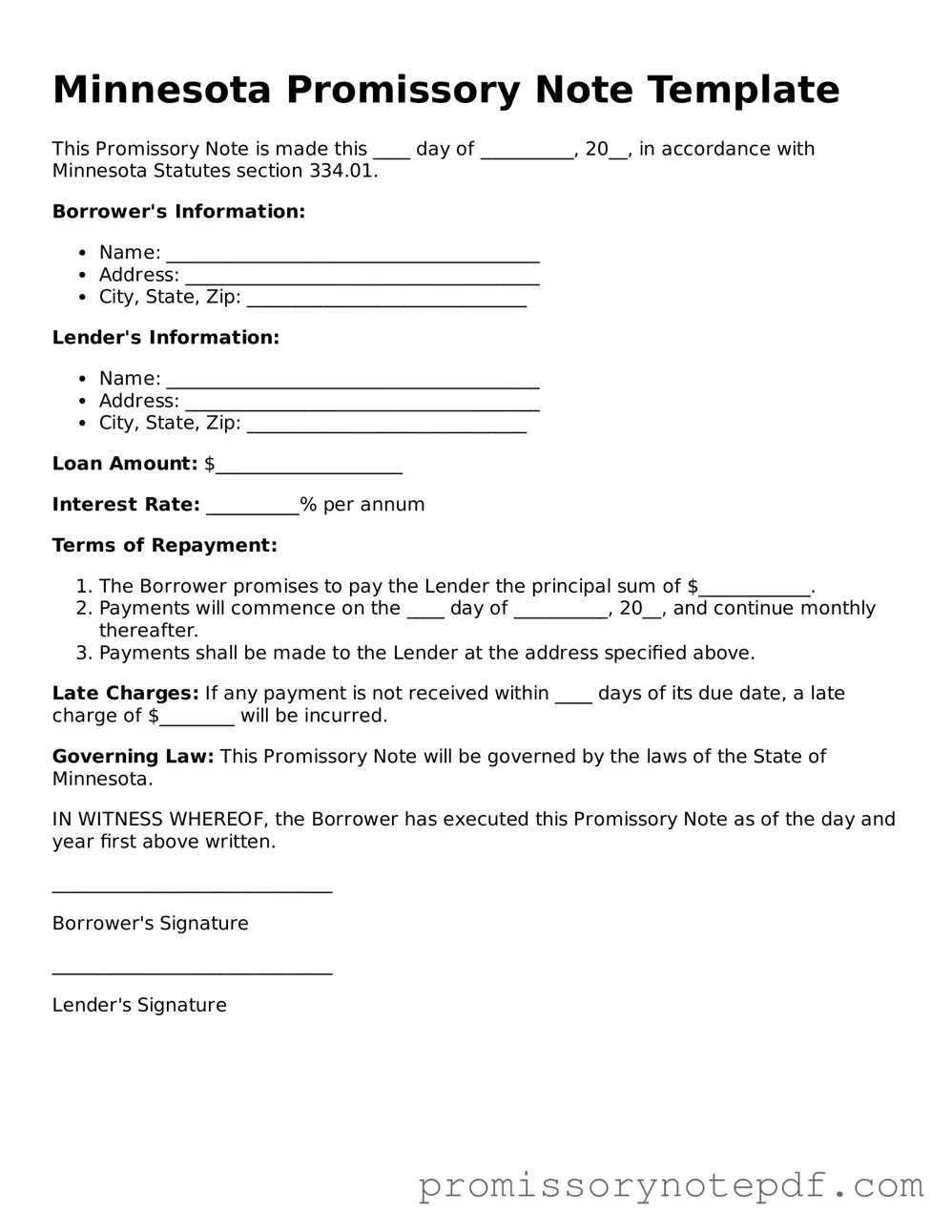

Inaccurate Borrower Information: One common mistake is providing incorrect or incomplete details about the borrower. This includes failing to include the full legal name, current address, or contact information. Such inaccuracies can lead to complications in enforcing the note.

-

Omitting Loan Amount: Some individuals neglect to clearly state the loan amount. It is essential to specify the exact dollar amount being borrowed to avoid disputes later on. Ambiguity in this section can result in misunderstandings between the lender and borrower.

-

Failure to Specify Interest Rate: Another frequent error is not indicating the interest rate or leaving it blank. The interest rate should be clearly defined, as it affects the total repayment amount. Without this information, the terms of the loan may be unclear.

-

Not Including Payment Terms: Many people overlook the importance of detailing the payment schedule. This includes the frequency of payments (monthly, quarterly, etc.) and the due dates. Clear payment terms help both parties understand their obligations.

-

Ignoring Signatures: Lastly, a common oversight is failing to sign the document. Both the borrower and lender must sign the promissory note for it to be legally binding. Without signatures, the note may not hold up in court if disputes arise.