Common mistakes

-

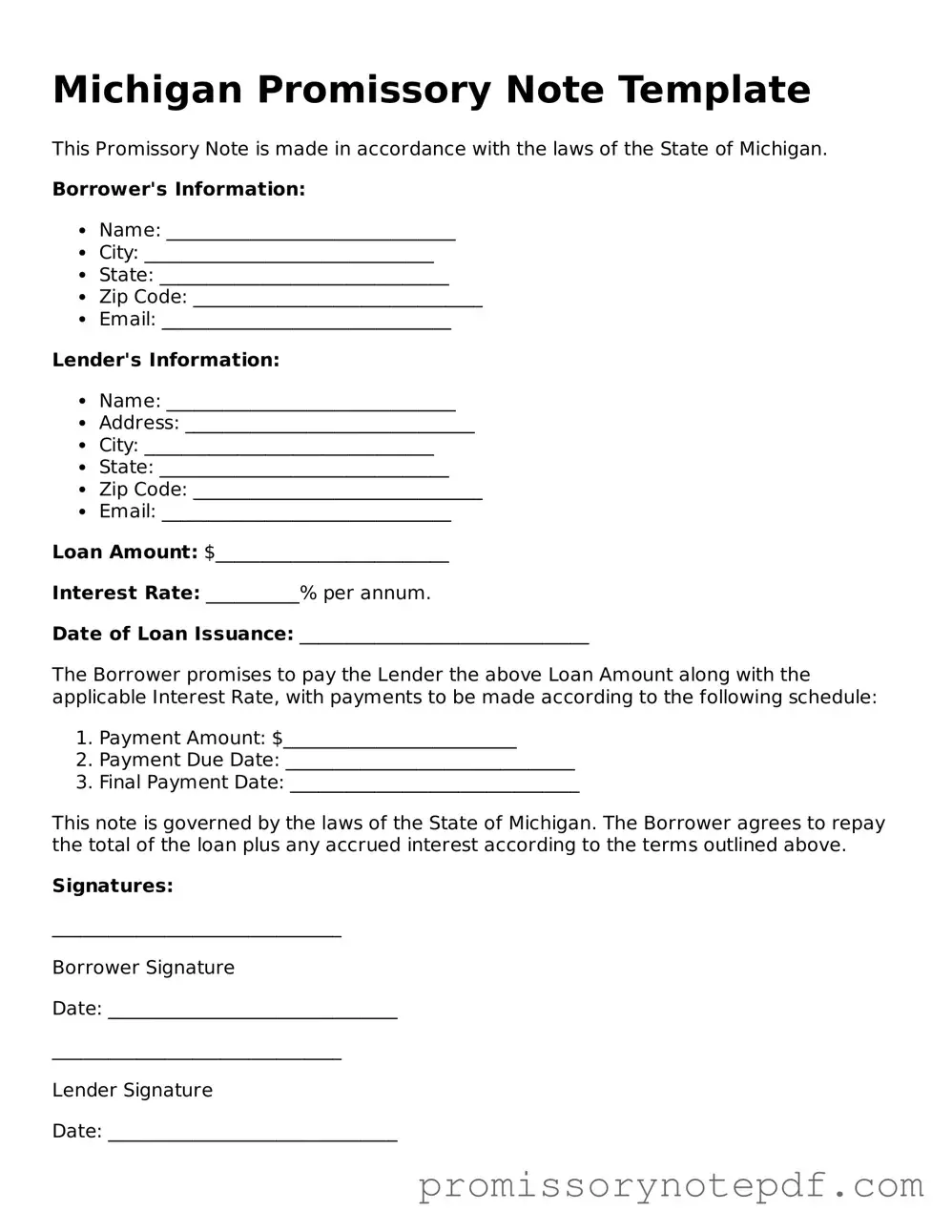

Inaccurate Borrower Information: Failing to provide complete and accurate details about the borrower can lead to issues in enforcement. Always double-check names, addresses, and contact information.

-

Missing Lender Information: Just as with the borrower, omitting the lender’s information can create confusion. Ensure that the lender's name and address are clearly stated.

-

Not Specifying the Loan Amount: Leaving the loan amount blank or writing it incorrectly can lead to disputes. Clearly state the total amount being borrowed.

-

Ignoring Interest Rate Details: If applicable, include the interest rate. Not specifying whether the loan is interest-bearing or not can complicate repayment terms.

-

Failure to Define Repayment Terms: Vague repayment terms can lead to misunderstandings. Clearly outline the repayment schedule, including due dates and payment methods.

-

Not Including Signatures: A promissory note is not valid without the signatures of both parties. Ensure that both the borrower and lender sign and date the document.

-

Neglecting to Include a Default Clause: Failing to specify what happens in the event of a default can leave both parties unprotected. Clearly outline the consequences of non-payment.

-

Not Keeping Copies: After completing the form, neglecting to make copies for both parties can lead to disputes later. Always retain a signed copy for your records.