Common mistakes

-

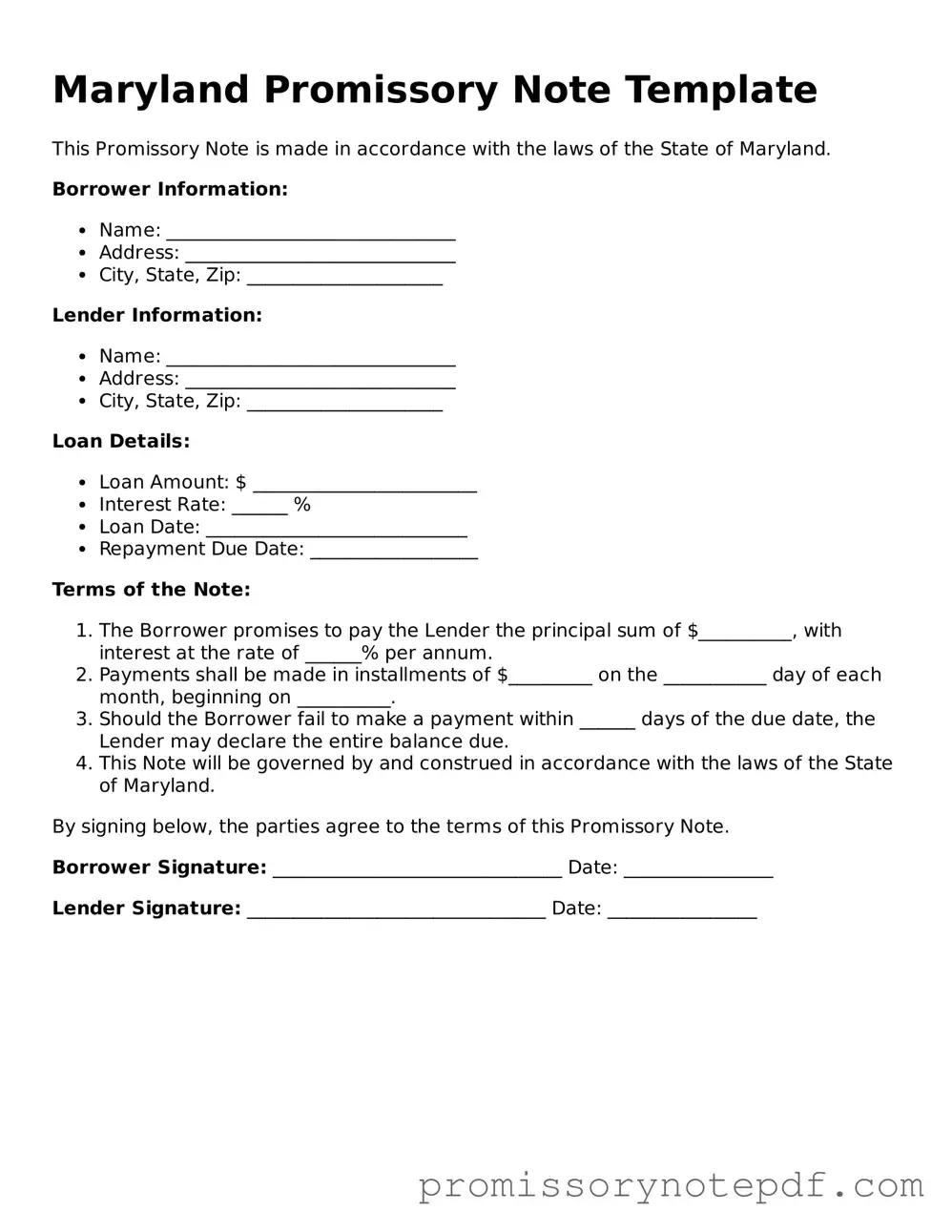

Failing to include the date on the promissory note. This omission can lead to confusion regarding the timeline of the agreement.

-

Not clearly identifying the borrower and the lender. It is essential to provide full names and contact information to avoid disputes later.

-

Neglecting to specify the loan amount. Without this crucial detail, the agreement lacks clarity and enforceability.

-

Omitting the interest rate or failing to indicate whether it is fixed or variable. This can result in misunderstandings about repayment obligations.

-

Not including the payment schedule. Clearly outlining when payments are due helps both parties manage expectations and responsibilities.

-

Using vague language regarding default terms. It is vital to define what constitutes a default and the consequences that follow.

-

Forgetting to sign the document. A signature is necessary to validate the agreement and make it legally binding.

-

Not keeping a copy of the signed note. Both parties should retain a copy for their records to reference the terms of the agreement in the future.