Common mistakes

-

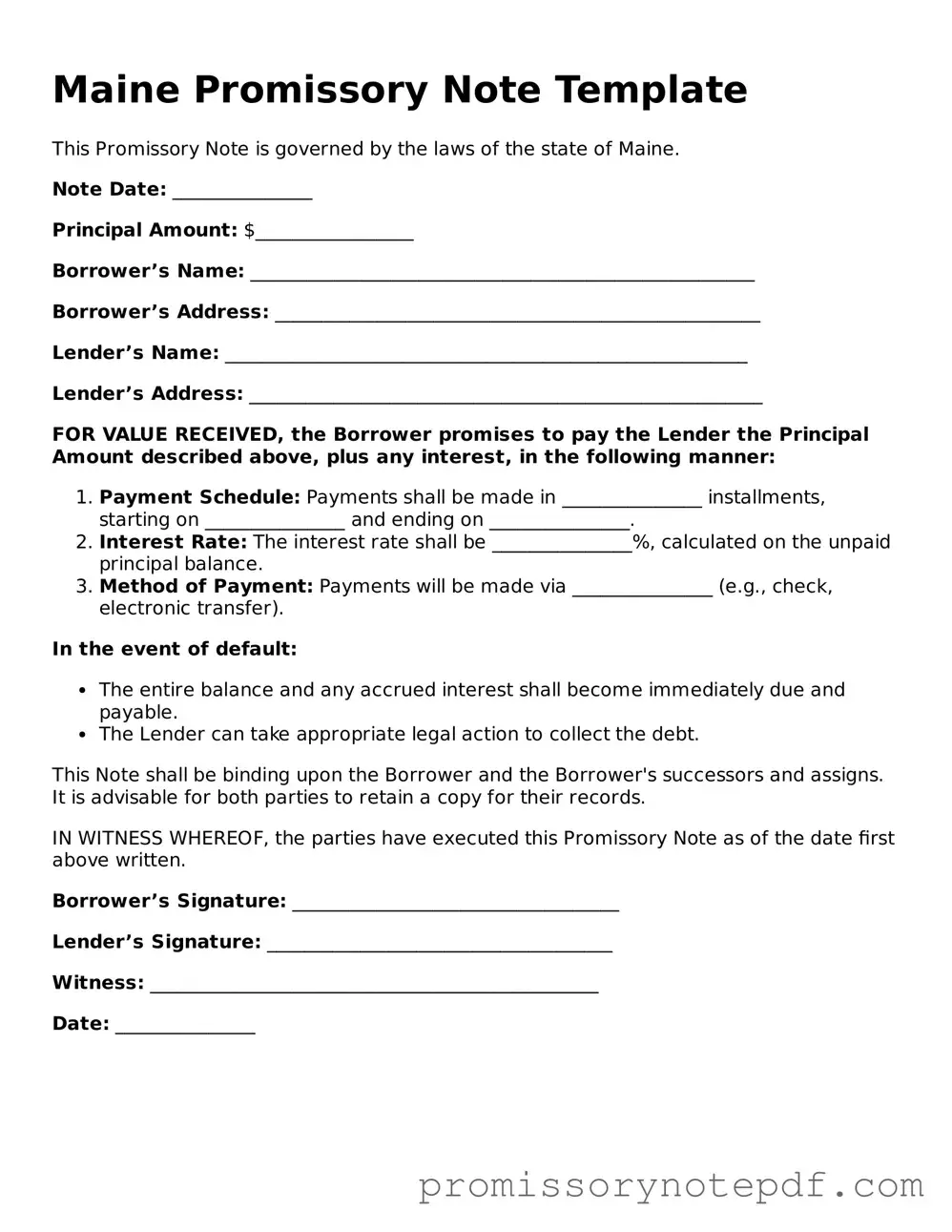

Not including all necessary information: Many people forget to fill out essential details such as the borrower’s name, address, and the loan amount. This omission can lead to confusion later on.

-

Failing to specify the interest rate: Some individuals neglect to state the interest rate clearly. Without this information, it can be difficult to determine the total amount to be repaid.

-

Omitting the repayment schedule: It's crucial to outline when payments are due. Many people either leave this section blank or provide vague terms, which can create misunderstandings.

-

Not signing the document: A common mistake is forgetting to sign the promissory note. Without a signature, the document may not hold up legally.

-

Using unclear language: Some individuals use ambiguous terms or phrases that can lead to misinterpretation. Clarity is key in a legal document.

-

Ignoring state-specific requirements: Each state may have unique regulations regarding promissory notes. Failing to adhere to Maine's specific guidelines can invalidate the note.

-

Not including a default clause: A default clause outlines what happens if the borrower fails to make payments. Omitting this can leave both parties unprotected.

-

Neglecting to keep copies: After filling out the form, some forget to make copies for both parties. This can lead to disputes over the terms of the agreement later on.