Common mistakes

When filling out the Kentucky Promissory Note form, individuals often encounter several common mistakes that can lead to confusion or legal issues. Below is a list of four frequent errors to avoid:

-

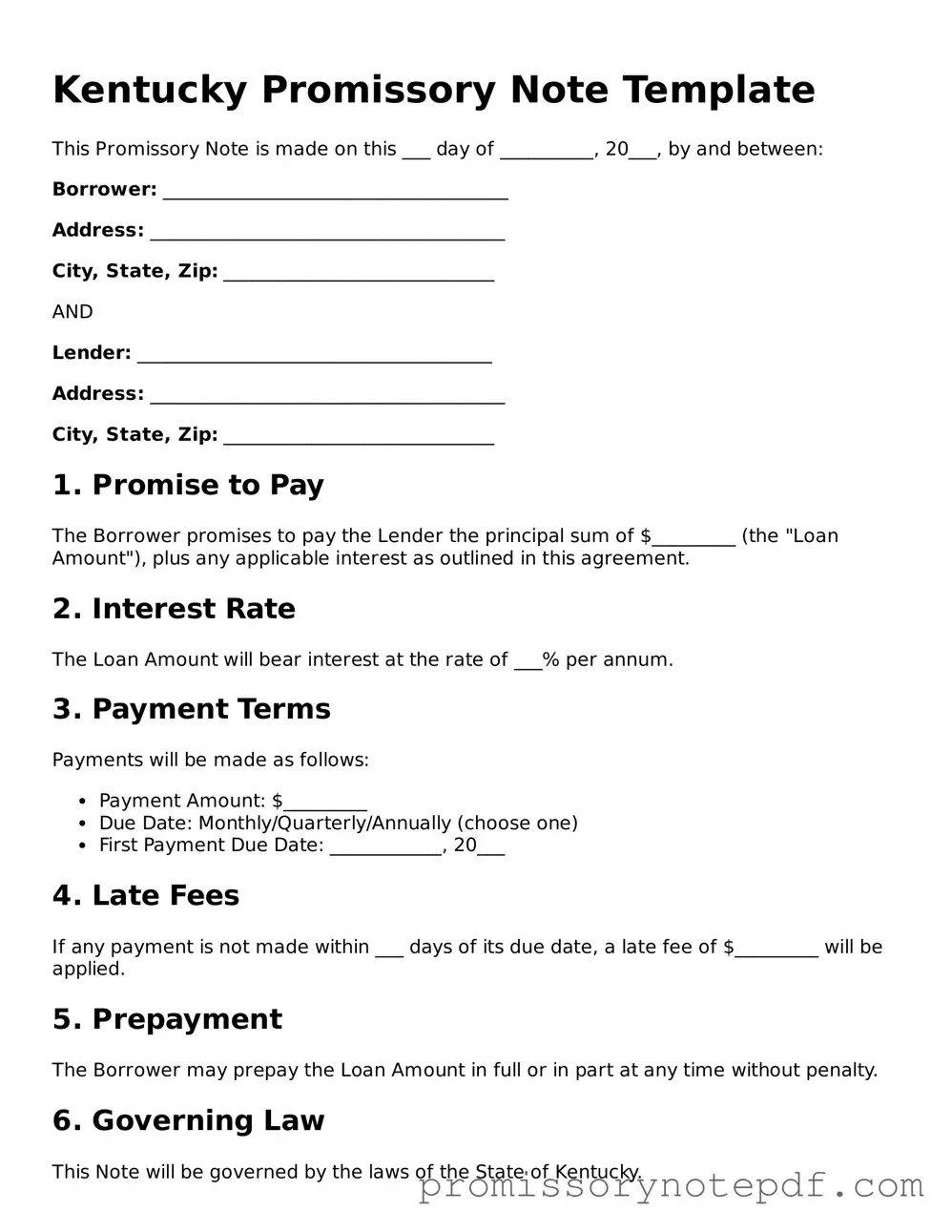

Incomplete Information: One of the most common mistakes is failing to provide all required information. This includes not filling in the names of both the borrower and the lender, or neglecting to specify the loan amount. Ensure that all sections of the form are completed thoroughly.

-

Incorrect Dates: Another frequent error is entering the wrong dates. It is essential to accurately record the date when the promissory note is signed, as well as the repayment due date. An incorrect date can create confusion regarding the terms of the loan.

-

Ambiguous Terms: Vague language can lead to misunderstandings. Clearly outline the repayment terms, including interest rates and payment schedules. Avoid using general terms that may not convey the intended meaning.

-

Failure to Sign: Lastly, neglecting to sign the document is a critical mistake. Both the borrower and the lender must sign the promissory note for it to be legally binding. Without signatures, the note may not be enforceable in a court of law.

By being mindful of these common mistakes, individuals can ensure that their Kentucky Promissory Note is completed accurately and effectively. This diligence helps protect both parties involved in the loan agreement.