Common mistakes

When filling out a Kansas Promissory Note form, individuals may inadvertently make several common mistakes. Understanding these pitfalls can help ensure that the document is completed accurately and serves its intended purpose. Below is a detailed list of six mistakes to avoid:

-

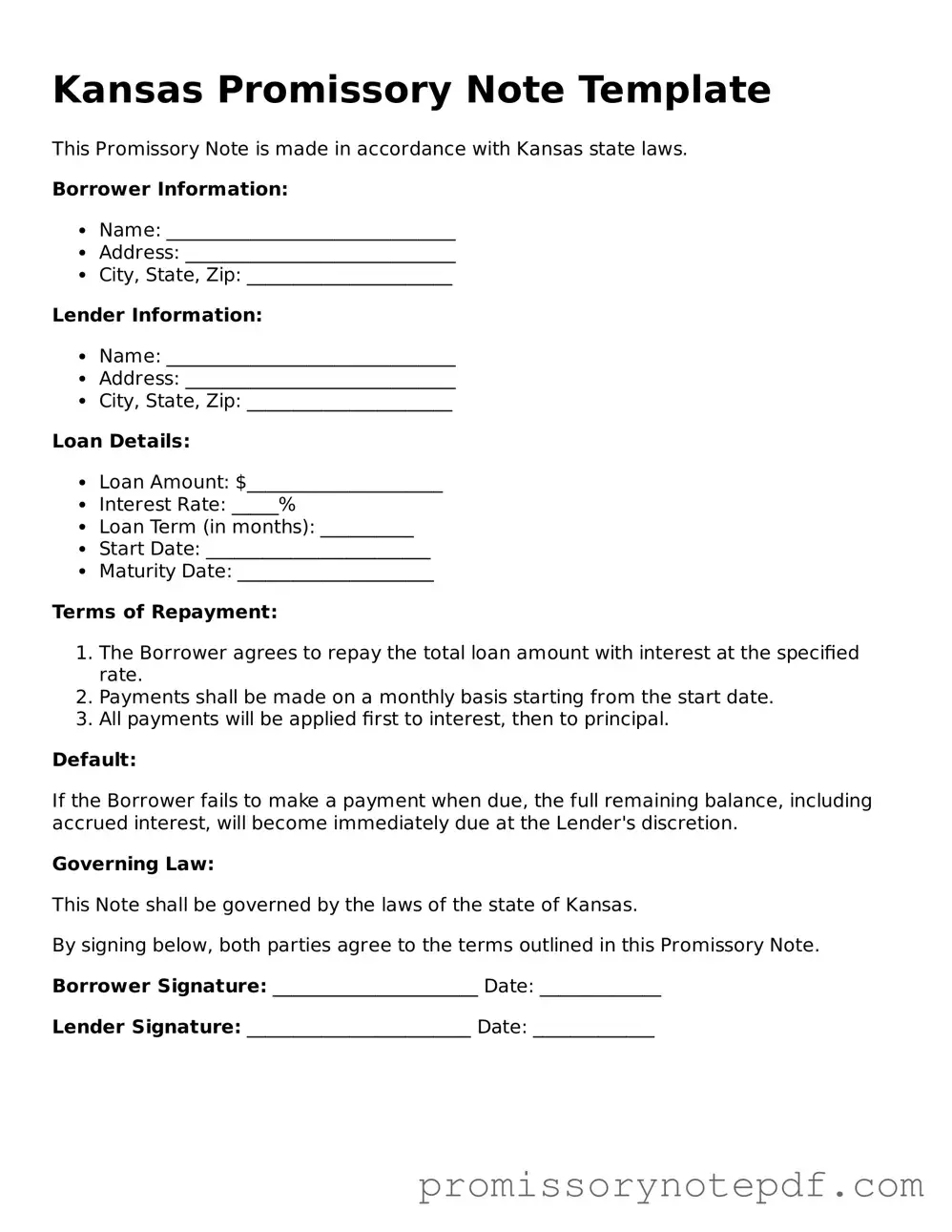

Neglecting to Include the Date: Failing to write the date on the form can lead to confusion about when the agreement was made. This date is crucial for determining the timeline of payments and any applicable interest.

-

Incorrectly Stating the Amount: It is vital to double-check the amount being borrowed. A simple error in the numerical figure or in the written words can create significant issues if disputes arise later.

-

Omitting Borrower and Lender Information: Both parties must be clearly identified. Leaving out names, addresses, or contact information can complicate communication and enforcement of the note.

-

Not Specifying Payment Terms: Clearly outlining the payment schedule, including due dates and amounts, is essential. Vague terms can lead to misunderstandings and potential legal challenges.

-

Ignoring Interest Rates: If applicable, the interest rate should be explicitly stated. Not including this information can lead to confusion about how much the borrower will ultimately repay.

-

Failing to Sign the Document: Both parties must sign the note for it to be legally binding. A lack of signatures renders the agreement unenforceable, which defeats its purpose.

By being mindful of these common mistakes, individuals can create a more effective and legally sound Promissory Note. Taking the time to review and verify each section of the form will help prevent future complications.