Common mistakes

-

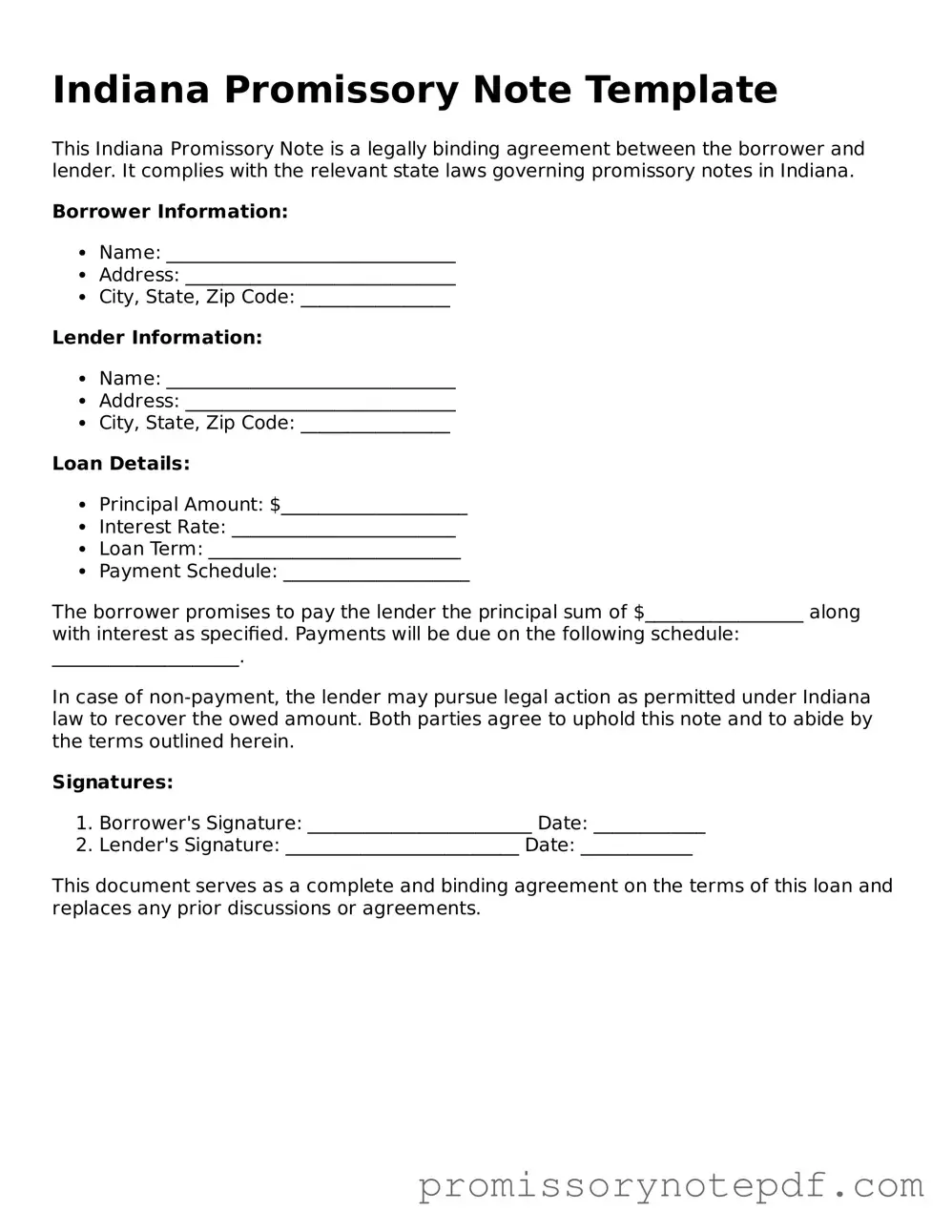

Incomplete Information: Failing to fill in all required fields can lead to confusion or disputes later on. Ensure that all sections, including names, addresses, and loan amounts, are fully completed.

-

Incorrect Dates: Entering the wrong date can invalidate the document. Double-check that the date of signing and the due date for repayment are accurate.

-

Missing Signatures: Both the borrower and lender must sign the document. A missing signature can render the note unenforceable.

-

Ambiguous Terms: Vague language can lead to misunderstandings. Clearly define the terms of repayment, including interest rates and payment schedules.

-

Ignoring State Laws: Not adhering to Indiana's specific requirements for promissory notes can result in legal issues. Familiarize yourself with local regulations to ensure compliance.

-

Failure to Include Payment Details: Omitting information about how and when payments will be made can create confusion. Specify the payment method and schedule clearly.

-

Neglecting to Make Copies: After signing, not making copies for all parties involved can lead to disputes about the terms of the loan. Always keep a copy for your records.

-

Not Considering Default Terms: Failing to outline what happens in the event of a default can leave both parties unprotected. Include clear consequences for missed payments.

-

Overlooking Witnesses or Notarization: Depending on the amount of the loan, some notes may require a witness or notarization. Check if this is necessary to ensure the document's validity.