Common mistakes

-

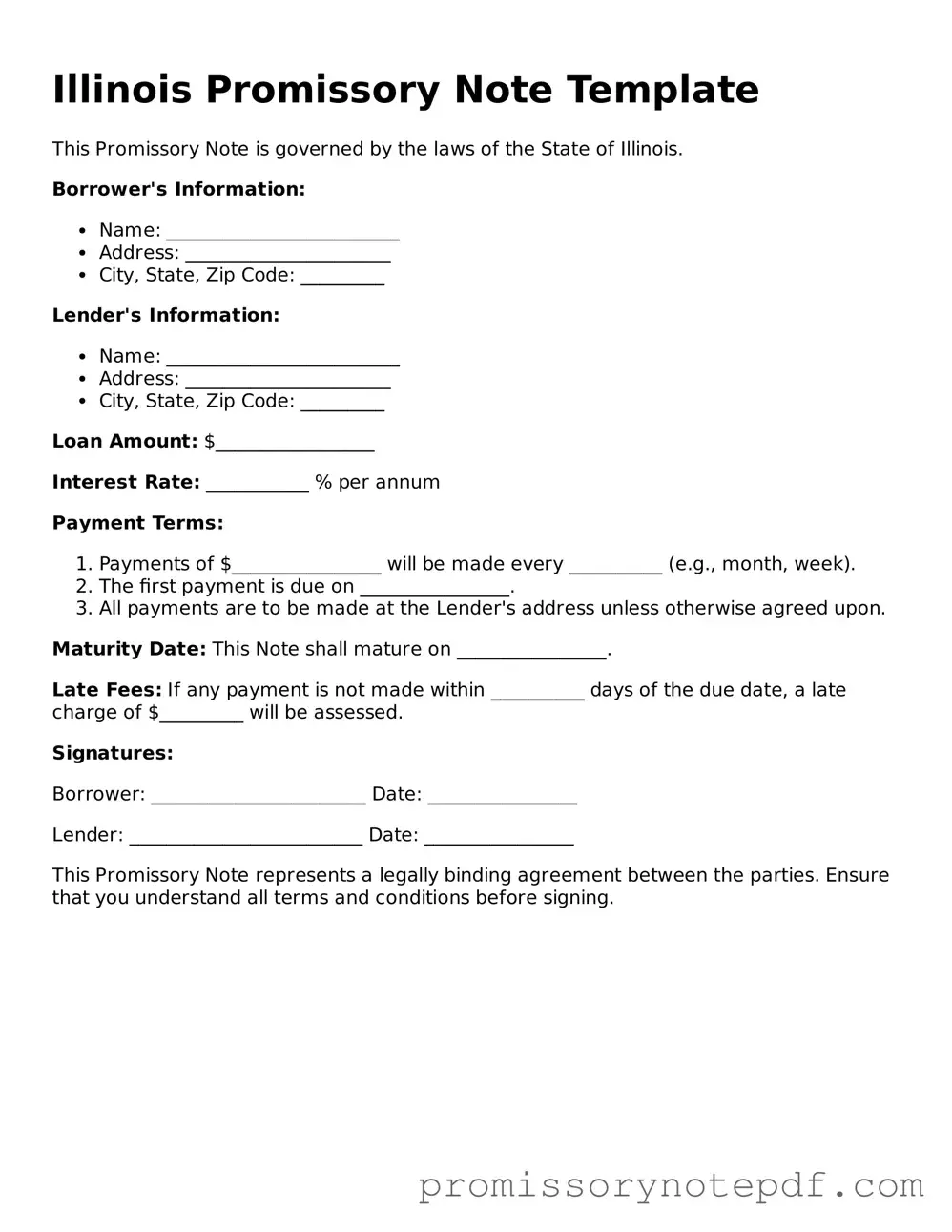

Not including the date: Failing to write the date at the top of the form can create confusion about when the agreement was made.

-

Incorrect borrower information: Providing inaccurate details about the borrower, such as name or address, can lead to issues in enforcing the note.

-

Omitting lender information: Just like the borrower, the lender's information must be complete and correct to ensure clarity in the agreement.

-

Leaving out the loan amount: The specific amount being borrowed must be clearly stated; otherwise, the terms become ambiguous.

-

Not specifying the interest rate: If applicable, failing to mention the interest rate can lead to misunderstandings about repayment obligations.

-

Ignoring repayment terms: Clearly outlining how and when payments will be made is essential. Vague terms can cause disputes later.

-

Not including a late payment clause: A clause detailing penalties for late payments can protect the lender's interests.

-

Forgetting to sign: Both parties must sign the document for it to be legally binding. A missing signature invalidates the agreement.

-

Neglecting to have witnesses or notarization: Depending on the situation, having the document witnessed or notarized can provide additional legal protection.

-

Using vague language: Clear and precise language is crucial. Ambiguous terms can lead to different interpretations of the agreement.