Common mistakes

-

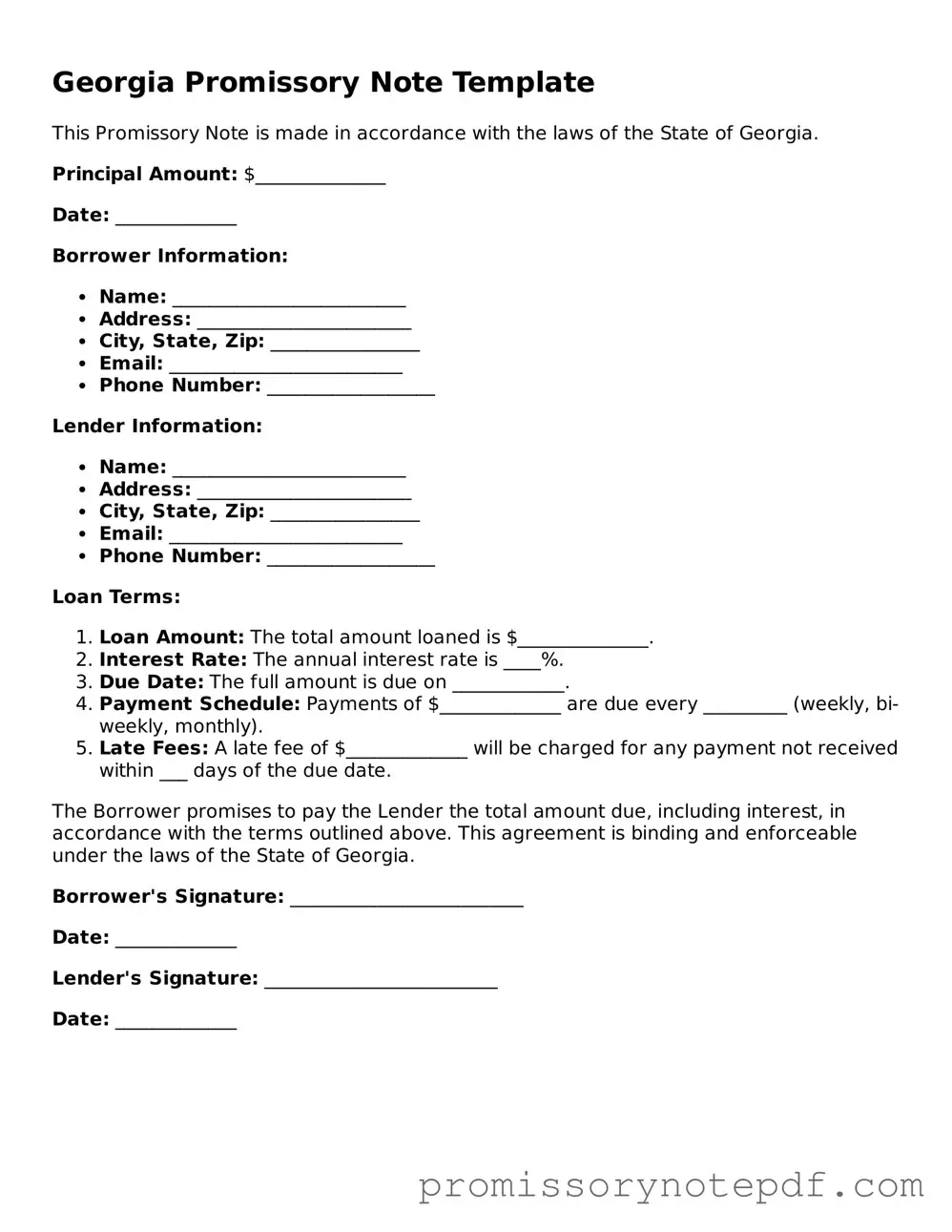

Incomplete Information: One common mistake is failing to fill out all required fields. This includes not providing the full names of the borrower and lender, the loan amount, and the interest rate. Leaving any section blank can lead to confusion or disputes later.

-

Incorrect Dates: Many people overlook the importance of accurate dates. Ensure that the date of signing is correct and that any repayment dates are clearly stated. An incorrect date can affect the enforceability of the note.

-

Ambiguous Terms: Using vague language can create problems. Clearly define the terms of the loan, including the payment schedule and any penalties for late payments. Ambiguity can lead to misunderstandings between parties.

-

Not Signing the Document: It may seem obvious, but some individuals forget to sign the Promissory Note. Both the borrower and lender must sign for the document to be valid. A missing signature can render the note unenforceable.