Common mistakes

-

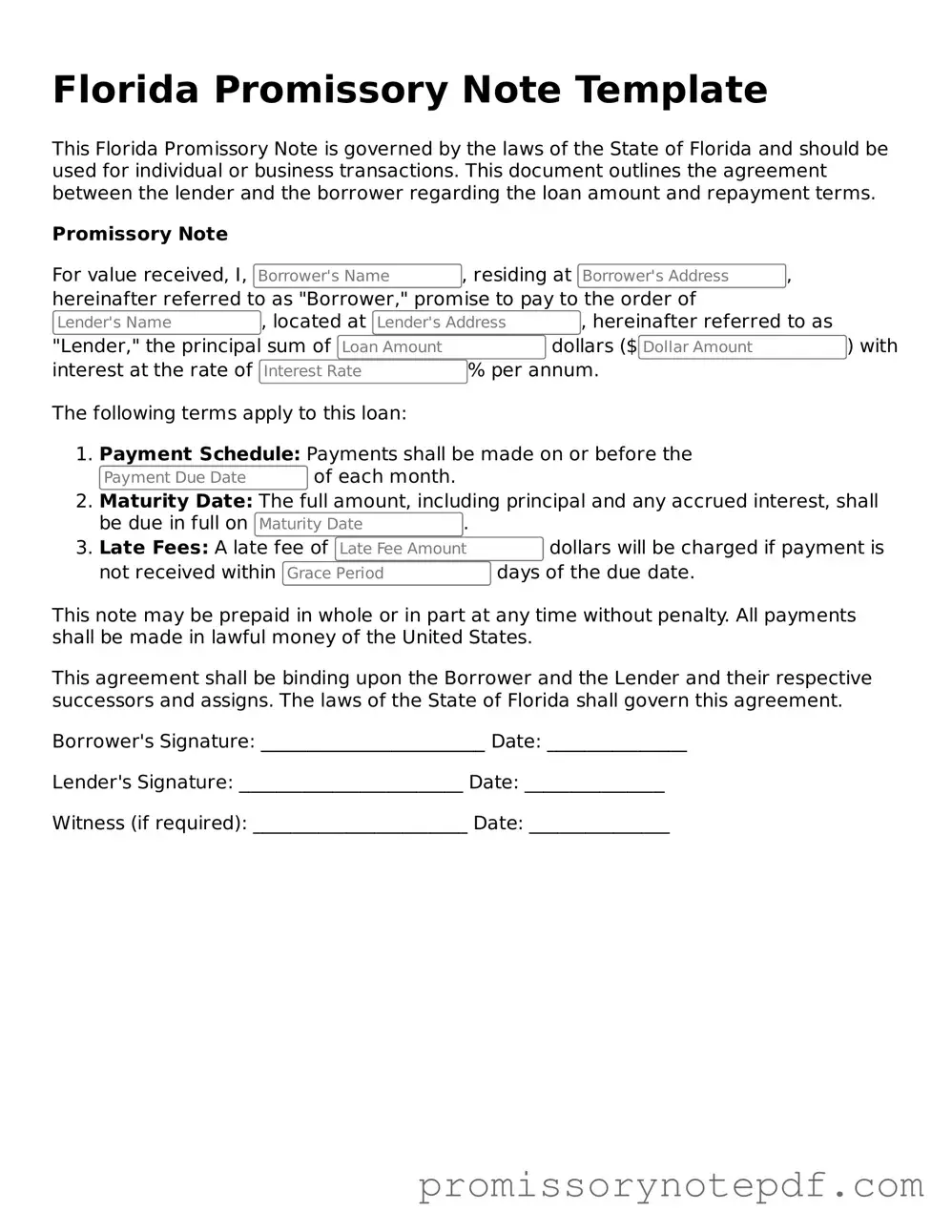

Incomplete Information: Failing to provide all required details can lead to confusion or disputes later. Ensure that names, addresses, and contact information are fully filled out.

-

Incorrect Loan Amount: Entering the wrong amount can create significant issues. Double-check that the principal amount reflects the agreed-upon loan.

-

Missing Signatures: Both parties must sign the document for it to be legally binding. Omitting a signature can render the note unenforceable.

-

Neglecting Dates: Dates are crucial for establishing the timeline of the loan. Ensure that both the date of the agreement and the repayment schedule are clearly indicated.

-

Ignoring Interest Rates: If applicable, the interest rate must be specified. Failing to do so may lead to misunderstandings about repayment terms.

-

Overlooking Repayment Terms: Clearly outline how and when payments will be made. Vague terms can lead to disputes and complications down the line.