Common mistakes

-

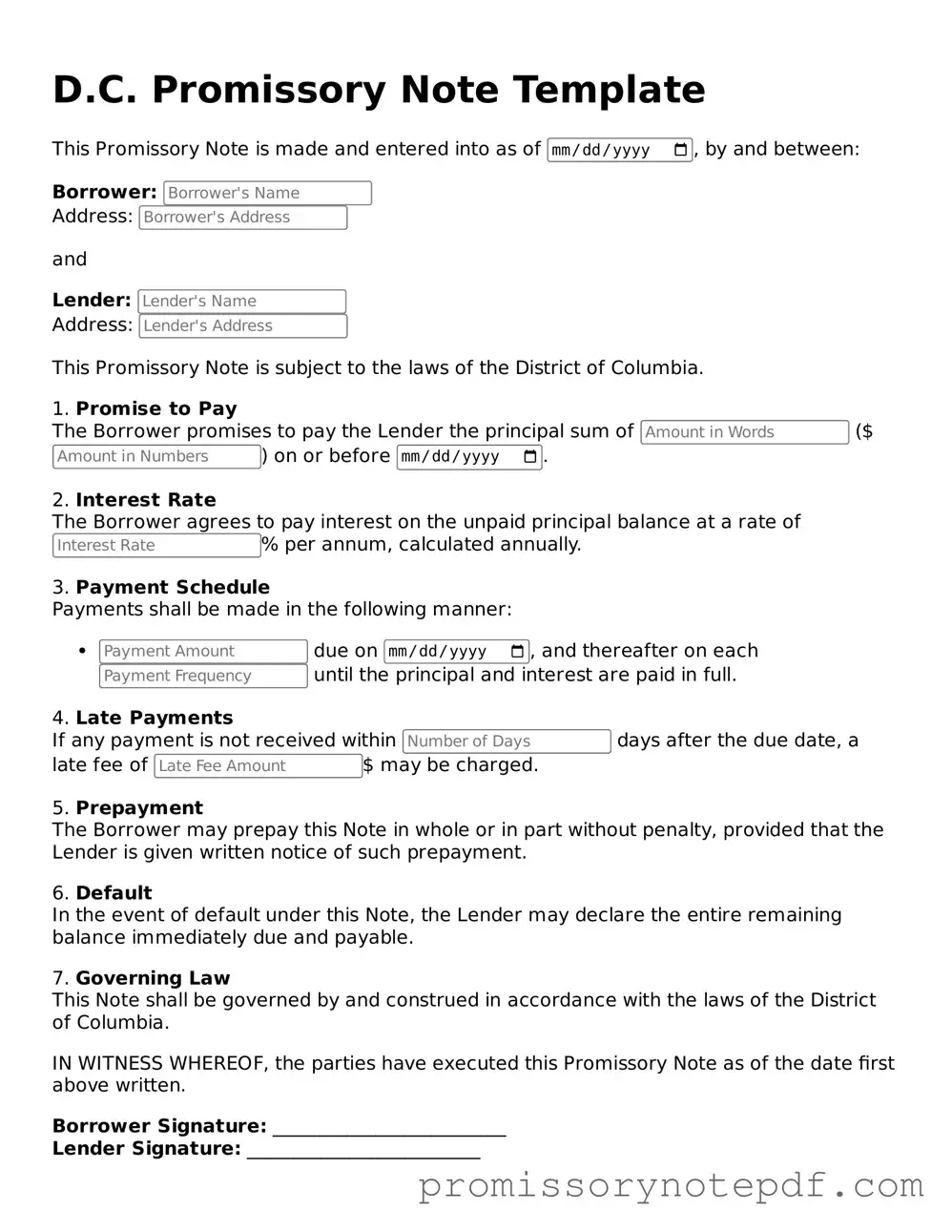

Not including the correct date. It is essential to write the date clearly at the top of the form. Missing or incorrect dates can lead to confusion about when the obligation begins.

-

Failing to identify the parties involved. Clearly state the names and addresses of both the borrower and the lender. Omitting this information can complicate future communications.

-

Not specifying the loan amount. Clearly indicate the total amount being borrowed. Without this, the note lacks clarity regarding the financial obligation.

-

Ignoring interest rates. If the loan includes interest, make sure to specify the rate. Leaving this blank can lead to misunderstandings about repayment terms.

-

Omitting repayment terms. Clearly outline how and when payments should be made. This includes the frequency of payments and any due dates.

-

Not including a default clause. It is important to define what happens if the borrower fails to repay the loan. This protects the lender's interests.

-

Failing to sign the document. Both parties must sign the note for it to be legally binding. An unsigned document may not hold up in court.

-

Not keeping copies. After filling out the form, both parties should keep a signed copy for their records. This helps avoid disputes later on.

-

Neglecting to consult a legal advisor. Before finalizing the note, it can be beneficial to seek legal advice. This ensures that all terms are clear and enforceable.