Common mistakes

-

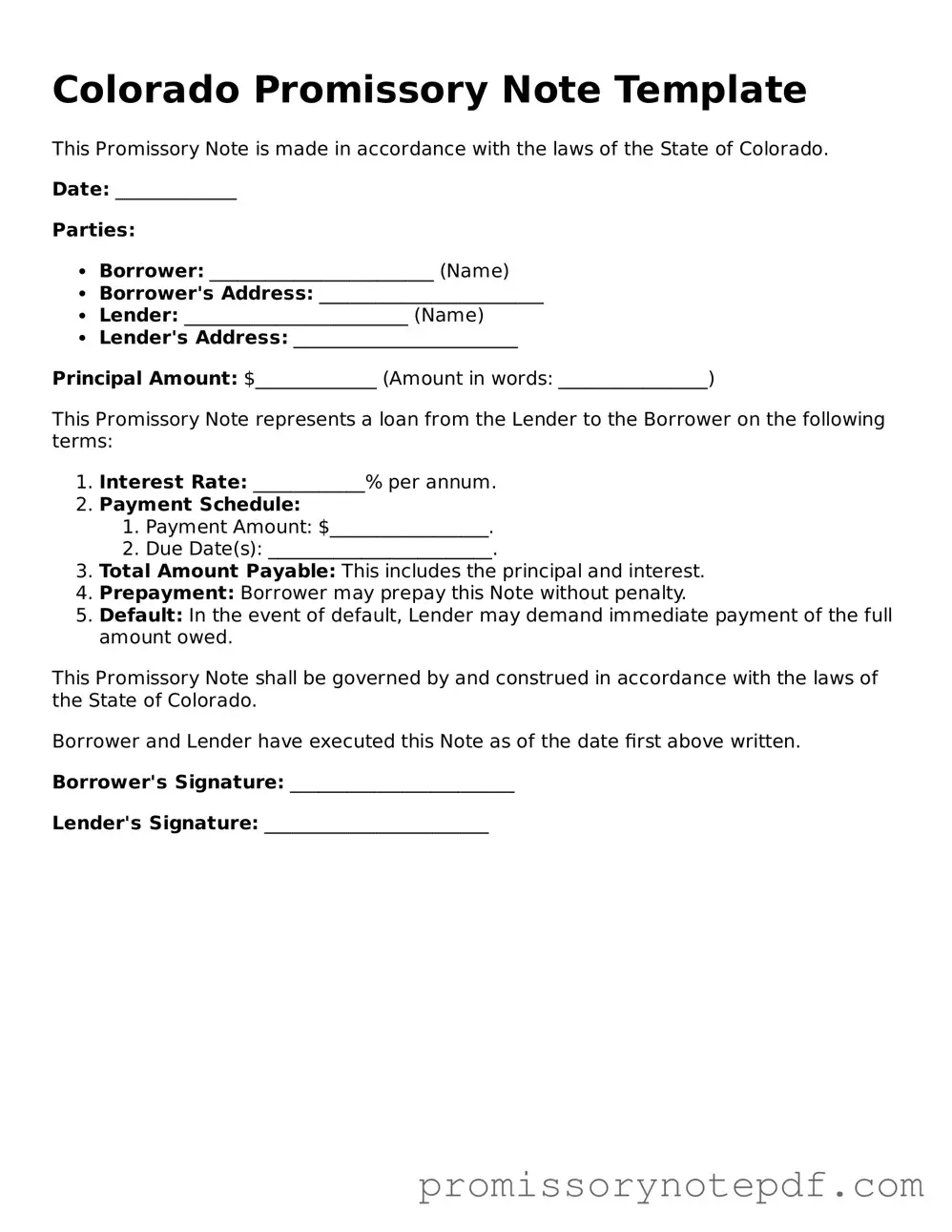

Incomplete Borrower Information: Failing to provide full names and addresses can lead to confusion later. Ensure that all details are accurate and complete.

-

Missing Lender Details: Just like with the borrower, it's essential to include the lender's full name and address. Omitting this can create issues in communication.

-

Incorrect Loan Amount: Double-check the loan amount written in both numbers and words. A discrepancy can cause disputes or misunderstandings.

-

Failure to Specify Interest Rate: Not indicating an interest rate or leaving it blank can lead to complications. Be clear about whether the loan is interest-free or has a specific rate.

-

Omitting Payment Schedule: It's vital to outline when payments are due. Not including a payment schedule may result in missed payments and financial strain.

-

Not Including Late Fees: If applicable, specify any late fees for missed payments. This helps both parties understand the consequences of late payments.

-

Neglecting to Sign: A signature is crucial for the validity of the note. Ensure that both the borrower and lender sign the document.

-

Ignoring Witness or Notary Requirements: Depending on the situation, having a witness or notary may be necessary. Check local regulations to ensure compliance.

-

Not Keeping Copies: After completing the form, both parties should retain copies. This ensures that everyone has access to the same information.

-

Overlooking State-Specific Regulations: Each state may have unique requirements for promissory notes. Familiarize yourself with Colorado's specific rules to avoid pitfalls.