Common mistakes

-

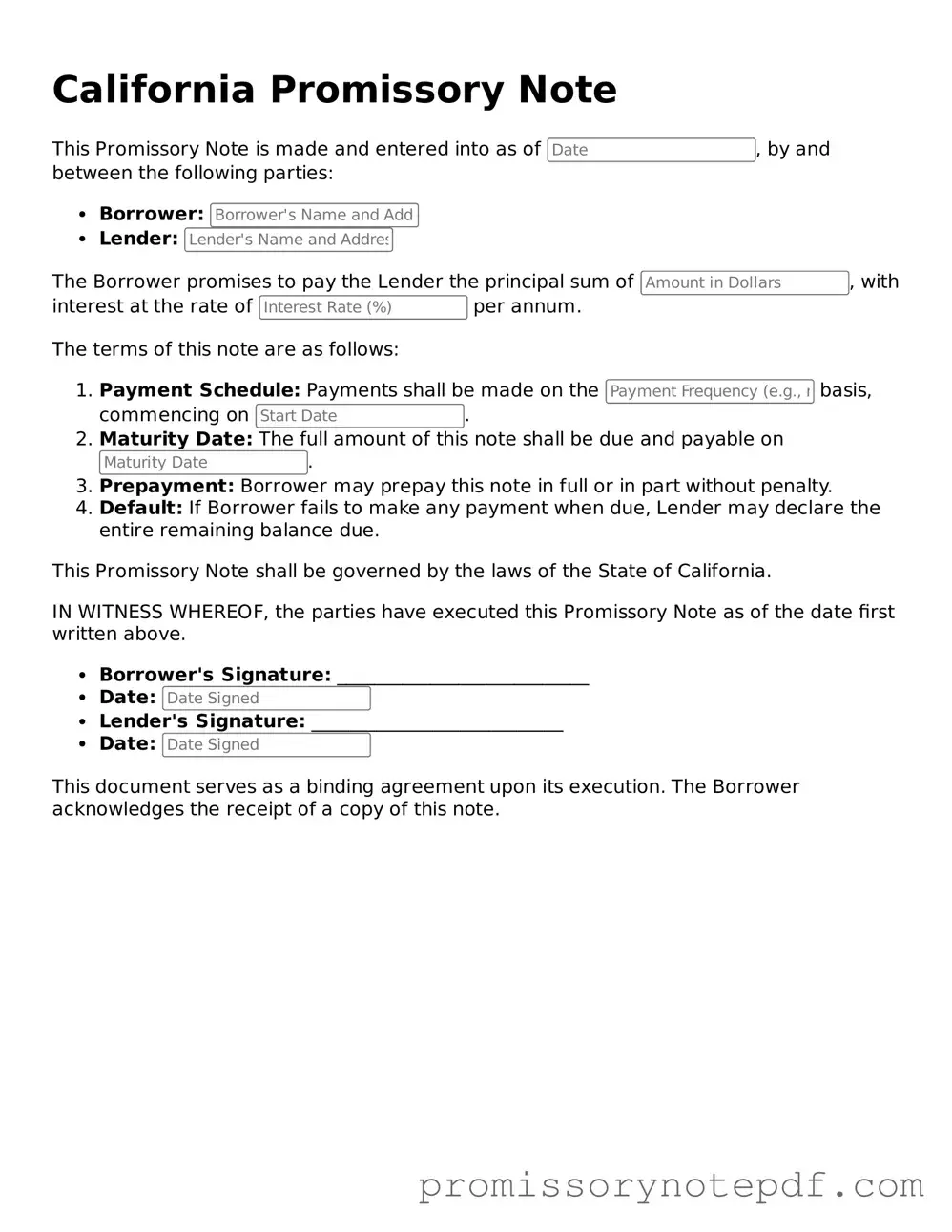

Incorrect Amount: Many people fail to write the correct loan amount. Double-check the figure to ensure accuracy.

-

Missing Date: Some forget to include the date when the note is signed. Always add this to avoid confusion later.

-

Wrong Borrower Information: Ensure that the borrower's name is spelled correctly and matches their identification documents.

-

Failure to Specify Interest Rate: Not indicating an interest rate can lead to disputes. Clearly state the rate to prevent misunderstandings.

-

Omitting Payment Terms: Some do not outline the payment schedule. Specify due dates and payment amounts to keep everything clear.

-

Neglecting Signatures: Both the borrower and lender must sign the document. Missing signatures can invalidate the note.

-

Inadequate Witness or Notary: Depending on the situation, a witness or notary may be required. Make sure to comply with these requirements.

-

Not Keeping Copies: Failing to make copies of the signed note can lead to issues later. Always keep a record for your files.