Common mistakes

-

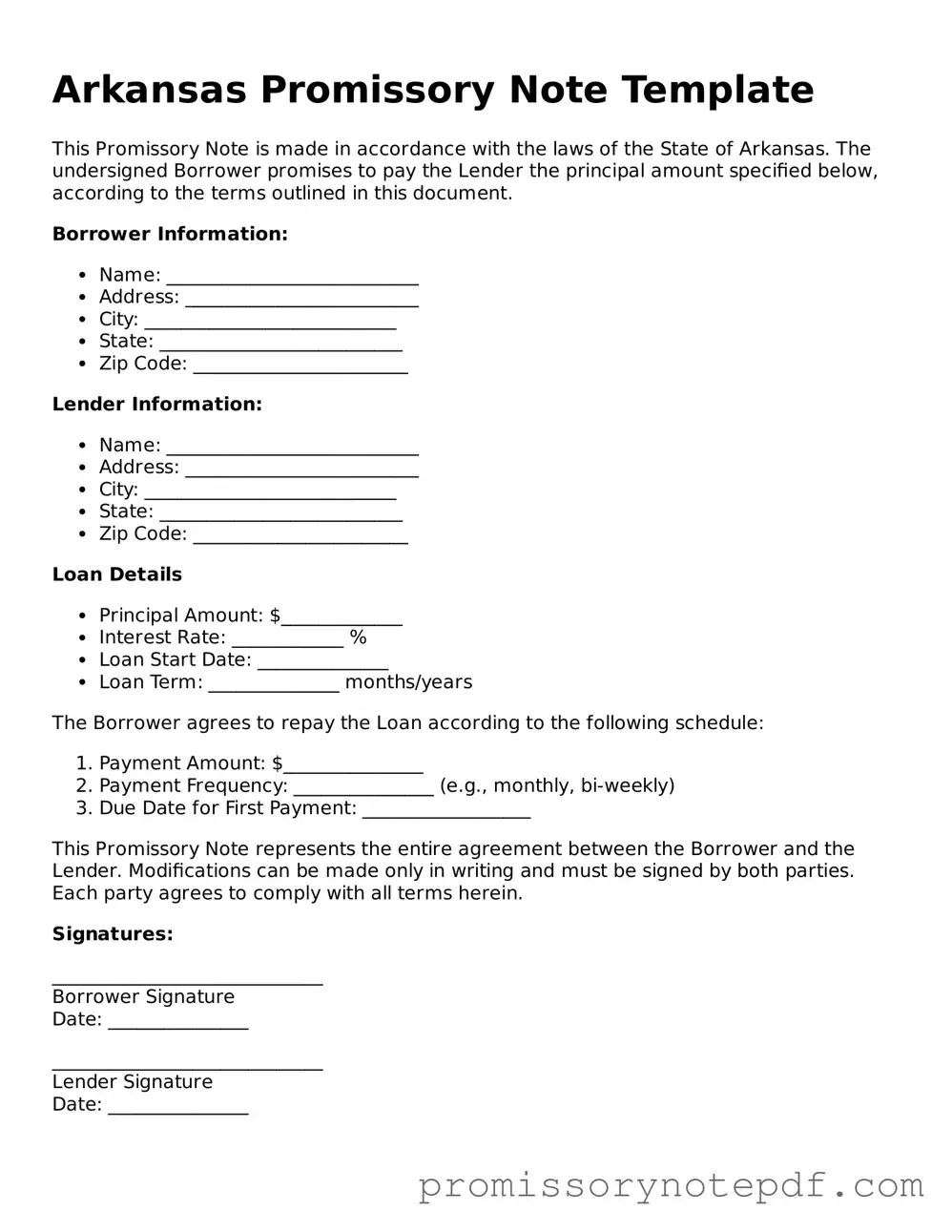

Incomplete Information: Failing to fill out all required fields can lead to complications. Each section must be completed accurately to ensure the note is valid.

-

Incorrect Names: Using incorrect names for the borrower or lender can cause confusion. It is essential to ensure that names are spelled correctly and match legal documents.

-

Missing Signatures: Not signing the document can render it unenforceable. Both parties must provide their signatures for the note to be valid.

-

Improper Dates: Failing to include the date of the agreement can lead to disputes. It is crucial to indicate when the note was executed.

-

Ambiguous Terms: Using vague language can create misunderstandings. Clear and specific terms regarding payment amounts and schedules should be included.

-

Ignoring State Laws: Not adhering to Arkansas state laws regarding promissory notes can result in legal issues. Familiarity with local regulations is important.

-

Failure to Include Interest Rates: Omitting the interest rate can lead to confusion about repayment amounts. Clearly stating the interest rate is necessary.

-

Not Specifying Payment Method: Leaving out how payments will be made can lead to complications. It is advisable to specify whether payments will be made by check, cash, or another method.

-

Neglecting to Keep Copies: Not retaining a copy of the signed note can cause problems later. Both parties should keep a copy for their records.

-

Failing to Review the Document: Skipping a final review can lead to overlooked errors. It is important to read the document thoroughly before signing.