Common mistakes

-

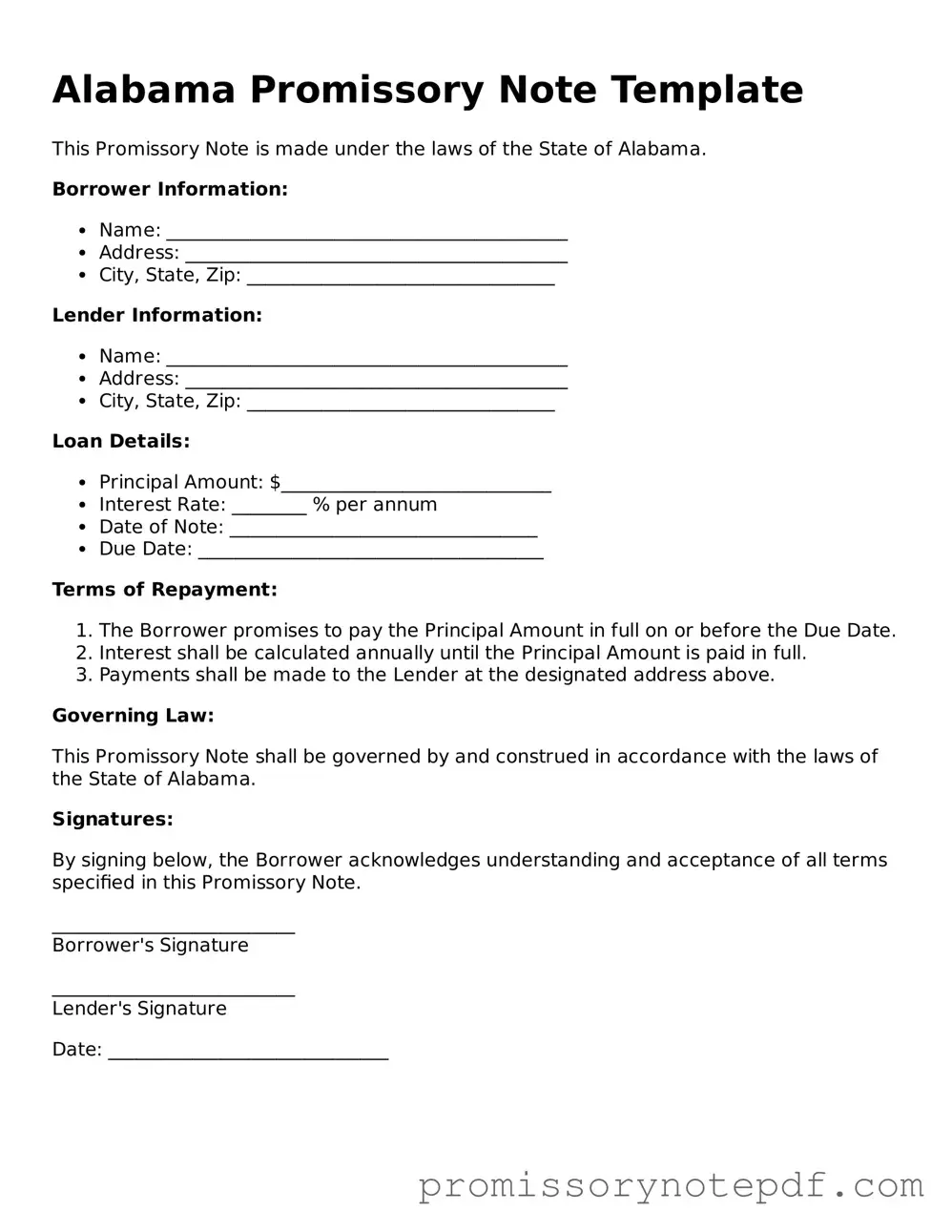

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. Ensure that every section of the form is completed, including names, addresses, and loan amounts. Leaving out any details can lead to confusion or disputes later on.

-

Incorrect Loan Amount: Double-check the loan amount entered. It’s easy to mistype a number, which could result in significant discrepancies. Always verify the amount to avoid issues down the line.

-

Missing Signatures: Both parties must sign the document for it to be legally binding. Forgetting to sign or having only one party sign can invalidate the agreement. Ensure that all necessary signatures are present.

-

Improper Date Entry: The date of the agreement is crucial. Entering the wrong date can create misunderstandings regarding the terms of repayment. Always confirm the date before submitting the form.

-

Not Including Payment Terms: Clearly outline the payment schedule, including due dates and interest rates. Vague or missing terms can lead to disputes. Specify how and when payments should be made.

-

Neglecting to Keep Copies: After completing the form, it’s important to retain copies for personal records. Not having a copy can lead to issues if disputes arise later. Always keep a signed copy for reference.