Open Promissory Note Editor Here

Open Promissory Note Editor Here

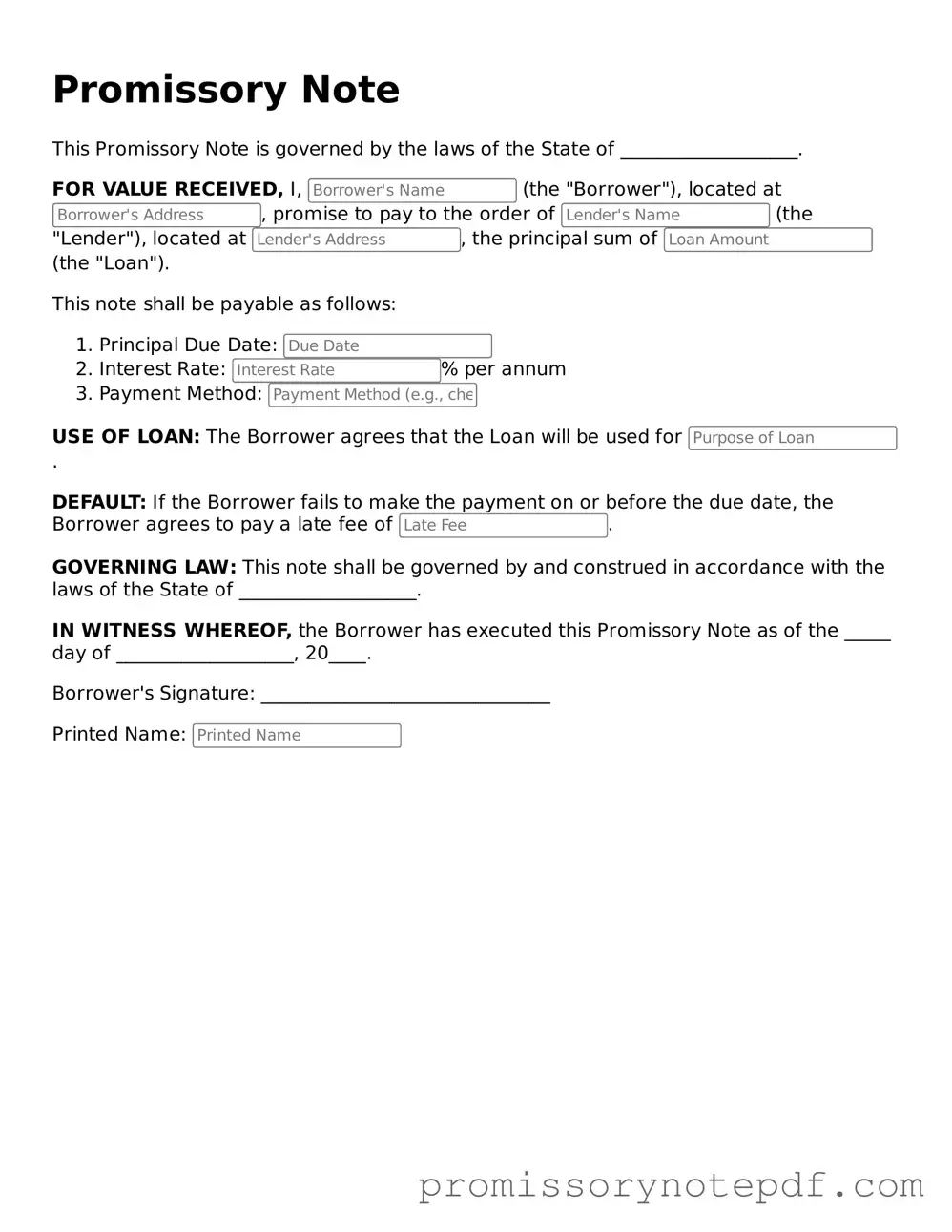

Blank Promissory Note Form

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined future date or on demand. This financial document serves as a crucial tool in personal and business transactions, establishing clear terms for repayment. Understanding its components can help ensure that both parties are protected and informed throughout the lending process.

Ready to take the next step? Fill out the Promissory Note form by clicking the button below.

The Promissory Note form serves as a crucial document in financial transactions, establishing a clear agreement between a borrower and a lender. This form outlines the specific terms of a loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It acts as a written promise from the borrower to repay the borrowed sum, ensuring that both parties have a mutual understanding of their obligations. Additionally, the Promissory Note can include provisions regarding late payments and default, protecting the lender's interests while providing the borrower with a clear framework for repayment. By detailing these essential elements, the form not only fosters transparency but also provides legal protection in the event of disputes. Understanding the significance of the Promissory Note form is vital for anyone involved in lending or borrowing money, as it lays the foundation for a responsible and accountable financial relationship.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Common mistakes

-

Incorrect Borrower Information: Many individuals fail to provide accurate names or addresses. Ensure the borrower's full legal name and current address are clearly stated.

-

Missing Loan Amount: Some people neglect to specify the exact amount being borrowed. This figure must be clearly written in both numbers and words to avoid confusion.

-

Omitting Interest Rate: Failing to include the interest rate can lead to disputes later. Be sure to clearly state whether the loan is interest-free or includes a specific rate.

-

Ignoring Payment Terms: Not detailing the repayment schedule is a common oversight. Specify the frequency of payments, such as monthly or quarterly, and the due dates.

-

Not Signing the Document: A signed promissory note is crucial. Some individuals forget to sign or have only one party sign, which can invalidate the agreement.

-

Failure to Include Default Terms: Many overlook the importance of defining what happens in case of default. Clearly outline the consequences of missed payments to protect all parties involved.

Dos and Don'ts

When filling out a Promissory Note form, attention to detail is crucial. Here are some guidelines to follow.

- Do: Clearly state the amount being borrowed. Precision in this figure is essential to avoid confusion later.

- Do: Include the names and addresses of both the borrower and the lender. This information establishes clear identification of the parties involved.

- Do: Specify the repayment terms. This includes the interest rate, payment schedule, and due date.

- Do: Sign and date the document. A signature validates the agreement and makes it legally binding.

- Don't: Leave any sections blank. Incomplete information can lead to disputes or misunderstandings.

- Don't: Use ambiguous language. Clarity is key; vague terms can create legal challenges.

- Don't: Forget to keep a copy for your records. Documentation is vital for both parties.

- Don't: Ignore state laws regarding interest rates and lending. Compliance with local regulations is necessary to ensure the note is enforceable.

Document Information

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time. |

| Parties Involved | Typically, there are two parties: the borrower (maker) who promises to pay, and the lender (payee) who receives the payment. |

| Interest Rate | Promissory notes often include an interest rate, which is the cost of borrowing the money, expressed as a percentage. |

| Governing Law | Each state has its own laws governing promissory notes. For example, in California, the relevant law is found in the California Commercial Code. |

| Repayment Terms | The note outlines when and how the borrower will repay the loan, including any payment schedules or due dates. |

| Default Consequences | If the borrower fails to make payments, the note typically specifies the consequences, which may include late fees or legal action. |

| Transferability | Promissory notes can often be transferred to another party, allowing the new holder to collect payments. |

| Signature Requirement | A valid promissory note must be signed by the borrower, indicating their agreement to the terms of the note. |

Obtain Answers on Promissory Note

-

What is a Promissory Note?

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined time or on demand. This document serves as a legal instrument that outlines the terms of the loan, including the principal amount, interest rate, and repayment schedule.

-

Who uses a Promissory Note?

Individuals and businesses commonly use Promissory Notes in various financial transactions. For instance, when someone borrows money from a friend, family member, or financial institution, a Promissory Note can formalize the agreement. It provides clarity and protection for both the lender and the borrower.

-

What are the key components of a Promissory Note?

A typical Promissory Note includes the following essential elements:

- The names and addresses of the borrower and lender

- The principal amount borrowed

- The interest rate (if applicable)

- The repayment schedule, including due dates

- Any collateral securing the loan

- Signatures of both parties

-

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document. Once signed by both parties, it obligates the borrower to repay the loan under the agreed-upon terms. If the borrower fails to make payments, the lender has the right to take legal action to recover the owed amount.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both the borrower and lender agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised agreement to ensure clarity and enforceability.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender may pursue various remedies. These can include demanding full payment, taking legal action, or seizing collateral if one was provided. It is crucial for both parties to understand the implications of defaulting on a Promissory Note.

-

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, seeking legal advice can be beneficial. A lawyer can help ensure that the document meets all legal requirements and protects the interests of both parties involved.

-

Can a Promissory Note be transferred to another party?

Yes, a Promissory Note can typically be transferred or assigned to another party, depending on the terms outlined in the document. The new holder of the note assumes the rights to receive payments. It is advisable to inform the borrower of the transfer to maintain clear communication.

-

What is the difference between a Promissory Note and a Loan Agreement?

A Promissory Note is a simpler document focused primarily on the promise to repay a loan, while a Loan Agreement is more comprehensive. A Loan Agreement often includes additional terms and conditions, such as covenants, representations, and warranties. Both documents serve important roles in lending transactions.

Similar forms

A loan agreement is a document that outlines the terms and conditions of a loan between a borrower and a lender. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement often includes additional provisions, such as collateral requirements and default consequences, providing a more comprehensive framework for the loan arrangement.

A mortgage is a legal document that secures a loan for the purchase of real estate. Similar to a promissory note, it represents a borrower's promise to repay the loan. However, a mortgage also involves the property itself as collateral, which means that the lender has the right to take possession of the property if the borrower defaults on the loan. This adds a layer of security for the lender that is not present in a standard promissory note.

A personal guarantee is a document where an individual agrees to be responsible for a debt or obligation of another party. Like a promissory note, it involves a commitment to repay a specified amount. The key difference lies in the nature of the obligation; a personal guarantee typically extends beyond a single transaction, holding the guarantor accountable for the borrower's debts in various circumstances.

A credit agreement is a contract between a borrower and a lender that outlines the terms of a credit facility. It shares similarities with a promissory note in that it details the amount of credit extended and repayment terms. However, a credit agreement often encompasses a broader scope, including fees, covenants, and conditions that must be met during the term of the credit, making it more complex than a simple promissory note.

An installment agreement is a contract that allows a borrower to repay a loan in scheduled payments over time. This document is similar to a promissory note in that it specifies the repayment terms and total amount owed. The main difference lies in the structure; installment agreements typically break down payments into smaller, manageable amounts, while a promissory note may not specify such detailed payment schedules.

A lease agreement is a contract that grants a tenant the right to use a property in exchange for rent. While it is not a loan document, it shares similarities with a promissory note in that both involve a promise to pay a specified amount. The key distinction is that a lease agreement is focused on the use of property rather than the borrowing of funds, and it typically includes terms related to property maintenance and responsibilities.

A bond is a formal contract in which an issuer promises to pay back borrowed funds at a specified future date, usually with interest. Similar to a promissory note, a bond represents a debt obligation. However, bonds are generally issued by corporations or governments and can be traded in secondary markets, while promissory notes are typically private agreements between individuals or entities.

A letter of credit is a document issued by a financial institution that guarantees payment to a seller on behalf of a buyer. It is similar to a promissory note in that it represents a financial commitment. However, a letter of credit involves the bank as an intermediary, providing assurance to the seller that payment will be made, while a promissory note is a direct obligation between the borrower and lender.